Engage for Banking

Banks unify and manage customer relationships across all channels.

Download the InfographicCustomer segmentation: You’ve heard of it, you’re familiar with it, and you probably already use some form of it within your organization. In the digital age, data has become financial institution’s most valuable asset, providing insight into product performance, consumer behavior, market trends, and more. Customer segmentation plays a vital role in all of this, creating opportunities to better understand each customer’s needs and preferences and how to better target those needs and preferences in order to increase revenue.

But customer segmentation, taken on its own, isn’t enough. In order to see tangible results from your commercial or retail banking customer segmentation strategy, it needs to be effective.

Why Customer Segmentation in Banking Needs to Be Better

In early drafts of this article, this section was titled “What Basic Segmentation Gets Wrong.” We thought long and hard about that before shifting perspective — after all, it isn’t so much that basic segmentation gets things wrong, so much as it isn’t as effective as it could be.

You see, most banks base their segmentation around customer demographics (age, gender, income, geographic location, education, and so on). Although that’s useful — for example, it might tell you that customers between the ages of 30–40 are the most likely to apply for a home loan — it can only take you so far. This approach to customer segmentation in banking is limited because it lacks granularity and nuance; it relies on basic assumptions and treats each demographic as a homogenized group, when it’s anything but.

Basic segmentation is a good entry customer segmentation strategy, but you need to take things a step further and work to understand your customers as individuals. It’s a challenge almost every financial institution faces, regardless of whether it specializes in consumer, commercial, or retail banking.

Even organizations that excel at collecting really granular consumer data fail to leverage it as successfully as they could. For example, to return to the home loan example, let’s say that you go into your customer relationship management system and segment to see which customers have home loans with competitors. You then develop a marketing campaign to target these customers based on that information. Seems like a winning strategy, doesn’t it?

Not exactly. Your marketing campaign might convince a few customers to switch to your home loan product, which is a net positive — but your customer segmentation strategy would be even more effective if it indicated why those customers chose to work with other institutions in the first place. It could be for any number of reasons related to competitive products, relationship, or perhaps a lack of awareness of the products and services offered by your institution. Until you address the root cause, your customer segmentation strategy will continue to come up short.

Let’s extend this example to highlight another way in which banks fail to leverage granular consumer data as effectively as possible. Say you’re targeting a customer — let’s call him Jeff — who falls under the segment of customers who have home loans with competitors. You send him the same marketing campaign as all the other customers in this segment. However, in doing so, you fail to acknowledge the fact that earlier that month, Jeff approached your organization’s wealth group for investment advice. You see, Jeff’s grandmother recently passed away, leaving him with a sizable inheritance, which he’s looking to invest but needs some help to get started.

Although you have a comprehensive profile of Jeff — his preferences, what products he has, which ones he doesn’t, and so on — you chose to act on the wrong data, thereby missing out on a valuable opportunity and making it seem to Jeff as if you don’t know him at all.

None of these situations are ideal, whether it’s working with limited information, getting an incomplete picture of the customer, or misaligning with the customer’s needs. So, how can we make customer segmentation in banking better?

How Should You Segment Your Customers?

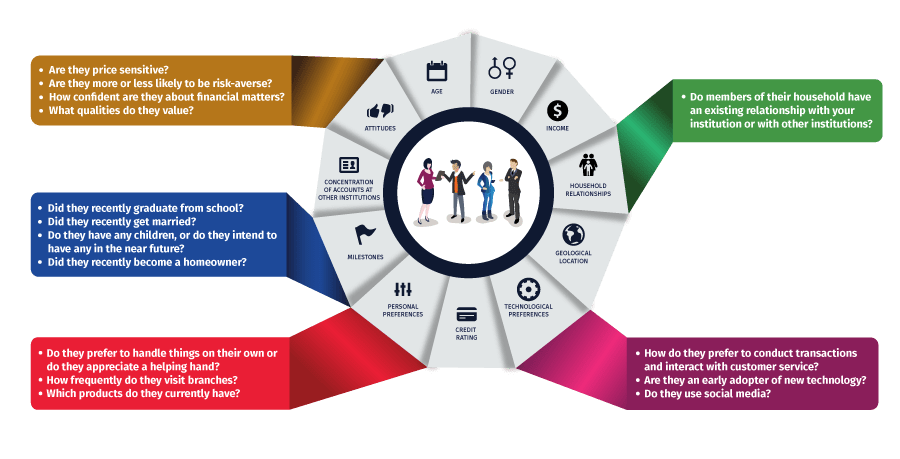

There’s no one way to segment; it really depends on your organization’s immediate needs. There are, however, a few things you might want to consider when developing customer profiles:

You can use this information to create customer profiles by persona — for example, let’s create a sample segment, which we’ll call “Up-and-Comers.” The customers that belong to this segment are relatively young — say, in the mid-20s to early 30s — are predominantly male and can most often be found in fashionable urban areas. They’re on the lower end of the income and credit spectrum, which makes them price sensitive, but they have the potential to significantly grow that income and credit score in the long-term. Up-and-Comers are also highly independent and technologically savvy, which means they prefer to handle their banking online, and visit branches infrequently. Based on this persona you’ve created, you might target customers in this segment by marketing to them over social media and offering them advanced self-service capabilities.

As you can see, it’s relatively easy to build profiles based on customer information and make strategic decisions to target each of these segments. Bear in mind that the nature of these profiles will vary depending on what type of banking you do — for example, in commercial banking, you’ll likely want to consider which industry or sector your customers work in.

Rules & Regulations

When it comes to marketing and communicating with customers, financial institutions aren’t off the hook for rules and regulations. While the vast majority of policies cover products, risk, and disclosure (particularly for consumers), there are also guidelines that could affect segmentation strategies and applicable content. For example, an effective segmentation strategy should align with proper content disclosures and shouldn’t exclude individuals or businesses in a way that could be interpreted as unfair according to the Equal Credit Opportunity Act.

Questions Every Banking Executive Should Ask

For executives at institutions that already do customer segmentation in banking, there are a few questions you should ask yourself in order to take your segmentation strategy to the next level:

- What information do we currently have access to?

- Where is that information located?

- Is any of that information incomplete?

- Which information is important?

- Are there opportunities to update that information?

- Does that information give us a clear view of the relationship across our products?

- What channels do we receive information through?

- Do these channels provide us with valuable information?

- Are we giving customers opportunities to help us across these channels?

- Who is the ideal customer?

- Who isn’t the ideal customer?

- Have we defined goals around ideal customers?

- What is the average number of products per customer?

- Do we have the ability to adapt our marketing approach based on changes in customer behavior?

Go One Step Further

Whether you’re building a customer segmentation strategy from scratch or simply trying to give your current strategy an upgrade, it’s important that you work with the right team. Other consulting agencies can help you identify account-centric information, but Hitachi Solutions takes things a step further by helping you establish relationships and then bring the available pipeline of customer intelligence to the forefront of those relationships. For instance, we will take a closer look at the various channels through which your customers interact to determine which ones provide the most value and whether there are opportunities for them to update their information, as well adjust preferences and segments based on their transactions and routine interactions. In doing so, institutions can be more confident that they are not only up to date but, more importantly, that they are aligned with the customer’s financial needs at the appropriate time.

Ready to give your customer segmentation strategy a facelift? Contact Hitachi Solutions today to get started.