The deduction workbench was originally designed for handling rebates from customers. But it can also be used for handling any customer short pays. The deduction workbench can be leveraged to help accountants better track when a customer has short paid and whether it was correct or not, instead of just leaving a remaining balance on the invoice. This process allows the invoice to be closed out, and researched further in the deduction workbench, without losing track of the short pay. Once the research is finished you can either write off the short pay to a ledger account if it was correct or deny the short pay and recreate the balance on the customer account under a new invoice number.

Configuration: Some basic configuration is needed before the deduction workbench can be used.

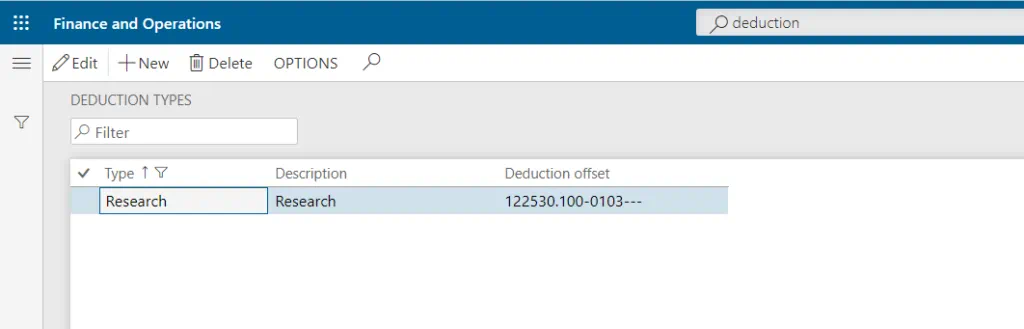

Deduction types: these are used for closing out the invoice and moving the amount onto the workbench.

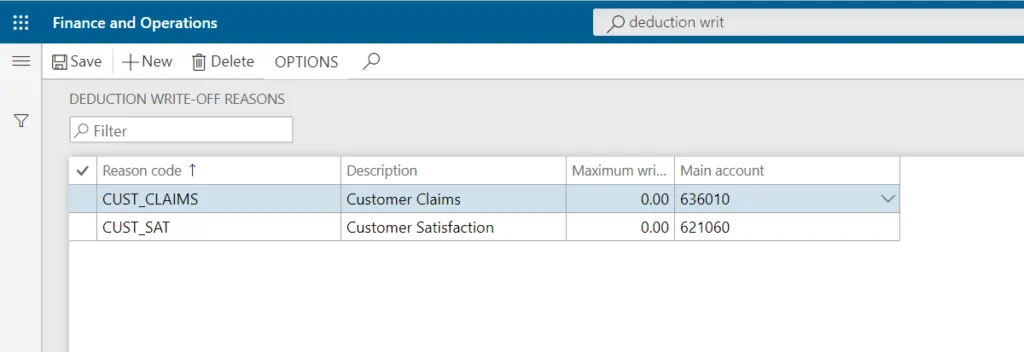

Deduction write-off reasons: These are used if the short pay was correct. It determines which ledger account the short pay should be written off to.

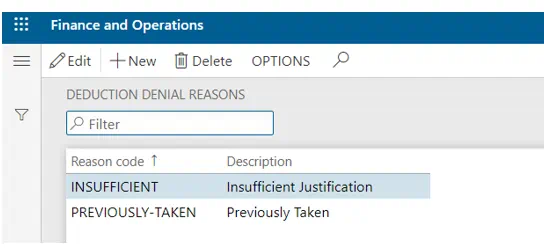

Denial Reasons: These are used if the short pay was not justified. No account is needed since it will reverse the deduction type entry and recreates the short pay on the customer account.

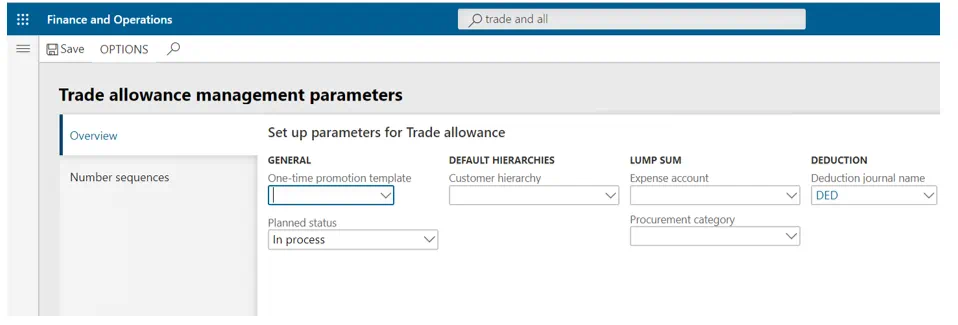

Journal Name: Define a Journal name in the Trade allowance management parameters in the deduction journal name field. It should be a daily type journal. The journal will be used when a deduction is written off or denied.

Scenario

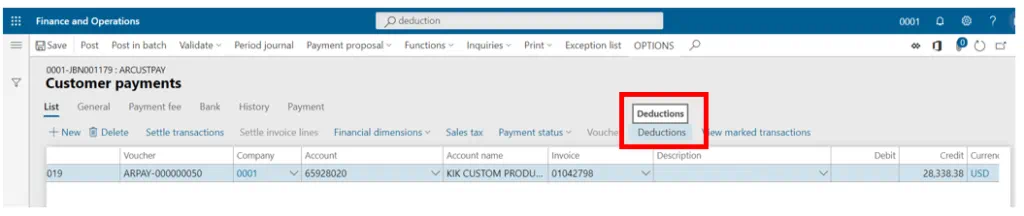

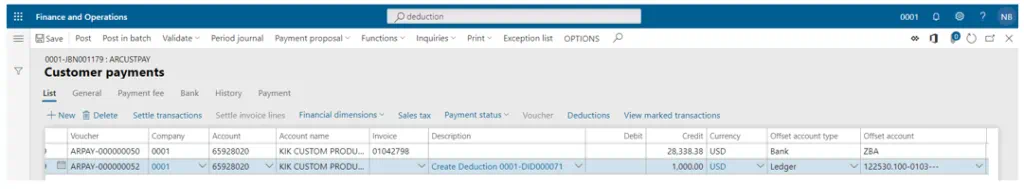

Here is an example of a customer short paying an invoice. The outstanding balance for the invoice is $29,338.38, but they short paid by $1,000. Once you have marked the payment against the invoice. Click on the deductions button just above the line.

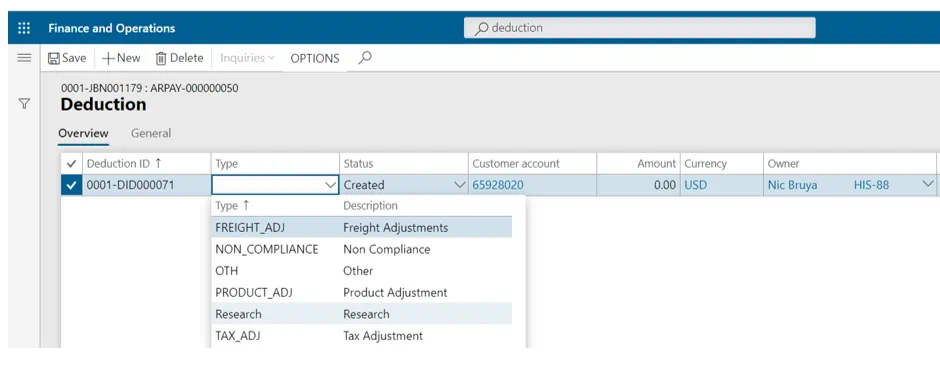

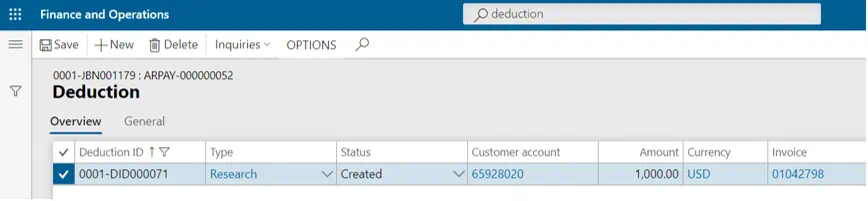

That will take you to a new form where you can select the type of deduction item you would like to create in the workbench. Notice the customer number is pulled in automatically based on the line that was selected on the previous form.

Once the Deduction type is selected. Enter the amount of the short pay, $1,000 and the invoice number.

Once the information is in entered, close the form. This will take you directly back to the payment journal. Once the information is verified, post the journal.

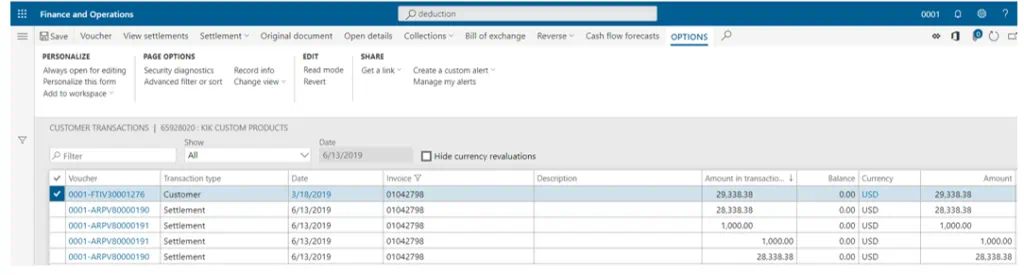

After the journal is posted, go to the customer transactions form to see how the payment journal posted. You can see that the invoice balance is zero dollars. It was closed by the combination of the check payment and the deduction item that was created.

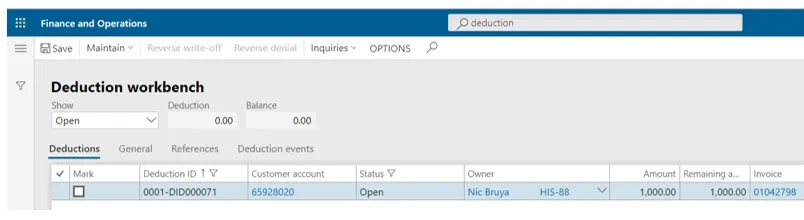

Next go to the infamous deduction workbench. Here we can see the deduction work item was created by the payment journal and in the workbench. It’s ready to be researched with a status of open.

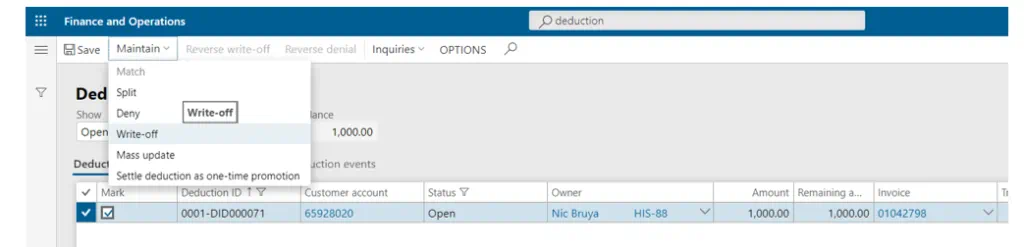

Once the item has been researched, go to the maintain button at the top and click the drop down. It will show you what options are available. The three options relevant to a short pay are Split, Deny, and Write-off. Split would as the name suggests, split the deduction into 2 or more. This way you could write-off different amounts to different ledger accounts. Or deny part of the deduction and write-off the remaining part.

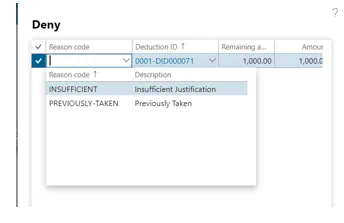

Deny will recreate the balance on the customer account using the deduction ID as the invoice number.

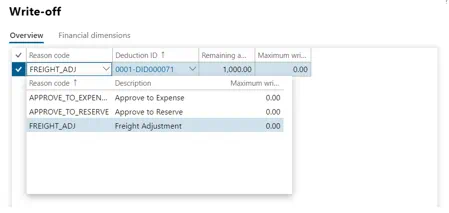

A write-off reason code will write-off the deduction amount to a specific ledger account.

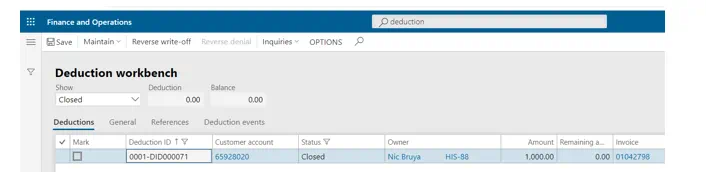

Either option will close out the deduction item changing its status to closed.

Summary

In summary, this is how you can use the deduction workbench to handle short pays. It will help when you are unsure why a customer is short paying, but you want to process and post the payment journal anyways. It allows you to track and research the short pay all within the deduction workbench. Without that, you would either need to hold the posting of the payment journal until the short pay is researched or posting the payment journal leaving a small open AR balance on the aging report. This can cause a lot of month end research, which can already be a very busy time.