Agency of the Future

Adapt to changes in the market, overcome consolidation challenges, and seize new revenue-generating opportunities by becoming the agency of the future.

Download the EbookData is arguably the most valuable currency of the digital age, and insurance companies are sitting on a veritable goldmine. Insurance companies experience a near-constant influx of data — actuarial data, market data, claims data, customer data, and so on. While many businesses in other industries are still figuring out how to derive value from data, the insurance industry has discovered that business intelligence is the key to realizing its potential.

In fact, according to Dresner Advisory Services’ 2020 Wisdom of the Crowds Business Intelligence Market Study, the financial services sector — which includes insurance companies — has the second-highest rate of cloud business intelligence adoption. For insurance companies, business intelligence plays an integral role in each of the following:

- Dashboards

- Reporting

- End user self-service

- Data warehousing

- Data discovery

- Data mining

With that in mind, let’s talk about business intelligence — specifically, what it is and how insurance companies can benefit from it.

What is Business Intelligence?

Business intelligence (BI) refers to the process of analyzing and interpreting data in order to derive valuable insights that inform key business decisions. BI software compiles company data and constructs detailed data visualizations of essential business processes and operations. Seeing the data in visual formats enables business leaders to identify patterns and use that information to make strategic decisions.

Business intelligence is often confused with business analytics; although the two are similar, they are not the same. Business analytics does much of the same work as BI, in terms of analyzing data and identifying patterns, and also forecasts the potential outcome of certain actions and behaviors. For example, an underwriter who works for an auto insurance company could use business analytics to perform a risk appraisal for a specific driver based on their driving history. This information would then be used to calculate the gross and net premium and to issue a policy to that driver.

Insurance business intelligence systems often include business analytics capabilities. Rolling data analytics, management, and migration functionalities all into one software system promotes better data quality and enables providers to be more efficient.

6 Benefits of Insurance Business Intelligence

1. Combat Insurance Fraud

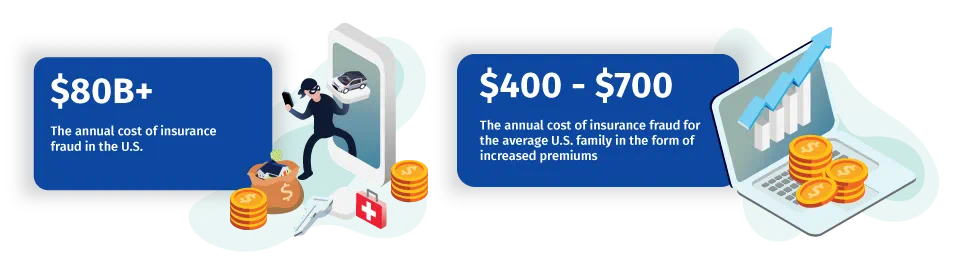

Fraud runs rampant in the insurance industry. It’s an unfortunate reality, to be sure, but a reality nonetheless, and insurance companies must take precautions to mitigate potential fraud.

According to the Coalition Against Insurance Fraud, the total cost of insurance fraud is estimated to be more than $80 billion per year in the United States alone. And fraud doesn’t just affect insurances companies — it takes a toll on insurance payers, as well. The cost of fraud can be exponential: As insurance companies lose revenue due to fraud, they often raise insurance premiums and rates to recoup costs, which results in a negative customer experience. The Federal Bureau of Investigation states that insurance fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums.

The good news is that insurance business intelligence software offers the ability to combat fraud in all its forms, from inflating actual claims to falsifying information on application forms. Effective fraud prevention requires early detection, and business intelligence uses predictive analytics — which combines artificial intelligence, machine learning, data mining, and predictive modeling — to identify fraudulent claims earlier in the claims cycle. By presenting the information via easy-to-understand visualizations, end-users can identify patterns that point to fraudulent activity and set up automated alerts based on these patterns.

2. Build Efficiency Into Claims Management

There’s nothing more frustrating to an insurance customer than a long, drawn-out claims process — and it’s easy to understand why: For most customers, that claim represents much-needed compensation for what could be a traumatic event, such as a car crash, property damage, or surgical procedure. An efficient claims process is vital to the success of any insurance company because it both increases customer satisfaction and minimizes loss. An optimized claims process also enables agents to resolve open claims that much faster, so they can dedicate their attention to a larger number of customers.

Insurance business intelligence solutions provide claims handlers with a holistic view of key business processes and performance, including open claims. By integrating business intelligence software with customer relationship management (CRM) systems, insurance providers can also give their claims handlers access to detailed customer profiles. Handlers can use this capability to review customers’ prior claims and other essential information and to deliver more expedient service, as well as a highly personalized customer experience.

3. Identify Profitable Opportunities

Just like any other business, insurance companies need to be on the lookout for ways to maximize their earnings. In order to do so, executives need to be able to view all parts of the business from a centralized location and in a convenient format.

As mentioned earlier, business intelligence software uses data analytics to create detailed visualizations, from which users can derive actionable insights. In addition to detecting fraud, insurance companies can use this capability to monitor market trends to make more strategic business decisions. These visualizations also make it possible for companies to monitor the performance of the various agencies that they partner with, as well as products within their own catalog, and determine where spending a little extra time and attention could lead to increased profit.

4. Better Enable Your Sales Team

Tasked with managing a large catalog of insurance products, often spread out across the globe, insurance company sales teams have the deck stacked against them. In order to consistently meet — and exceed — their team’s quarterly goals, sales managers must closely monitor the performance of each sales representative, product, and territory to determine whether they’re meeting expectations.

Insurance business intelligence solutions offer real-time reporting and generate detailed visualizations depicting individual product and agency performance, so sales managers and representatives can easily determine which areas of the business are performing well and which ones need attention, as well as identify potential growth opportunities.

5. Optimize the Underwriting and Sales Processes

Much like claims management, BI platforms have the ability to introduce efficiencies into the underwriting and sales processes.

Insurance business intelligence can provide a comprehensive view of the stages of the underwriting process — and the various steps that take place within each stage — in the form of data visualizations. In doing so, BI makes it possible to closely monitor the process, surface key details about each stage, identify potential bottlenecks, and highlight opportunities for improvement.

On the sales side of things, insurance business intelligence can support upselling and cross-selling efforts. If you capture submissions, such as requests for quotes, BI enables you to see the total number of quote requests and segment them by product, region, and even company size or industry (for commercial insurers). This information can help your sales team identify opportunities to sell additional policies via reports such as the white space report.

BI also paints a more complete picture of sales opportunities by capturing support lines for each policy. For example, if a policyholder were to renew their commercial auto policy, a sales representative could see and recommend related policies to that policyholder, such as commercial property insurance and workers compensation insurance.

Finally, BI enables both underwriting and sales teams to look at previous submissions to review underwriting comments, such as whether there was a variance in the policyholder’s premium, the reason for that variance, and so on.

6. Discover New Opportunities Using External Data Sources

One of the most compelling things about insurance business intelligence is that it enables you to pull data from external sources to optimize existing processes and discover new opportunities.

For example, you could integrate data from the National Weather Service to create weather prediction models and overlay policyholder data. Using these visualizations, you could monitor weather patterns by region and send messages to policyholders within those regions notifying them to take action — say, recommending that they put their car in their garage to avoid hail damage.

Clever reminders such as these not only enhance the customer experience — they also create upselling opportunities. Using the same example, if a particular region is routinely subject to specific weather patterns — hurricanes, tornados, snowstorms, and so on — you might proactively target policyholders within that region with offers for additional coverage, increased limits, or increased premiums to offset potential damage.

Weather pattern data is just one example of how insurance companies can leverage external data sources with BI; other examples include pulling data from services that provide financial reporting to underwrite commercial policies or predict risk and exposure.

Choose Power BI for More Intelligent Decision-Making

Hitachi Solutions is a leading provider of business intelligence software in the insurance industry. We partner with Microsoft to bring you Power BI for Insurance, a cloud-based business analytics service that empowers strategic decision-making and improves reseller partner and product performance.

Power BI for Insurance takes the copious amounts of data created by day-to-day insurance company operations and carefully analyzes that data to uncover actionable insights that drive business results. Explore exciting capabilities built specifically for the insurance industry, including a 360-degree view of business, powerful data analytics, interactive dashboards, and more.

Whether you want to learn more about the benefits of insurance business intelligence, or how Power BI for Insurance can help your company meet business objectives, Hitachi Solutions is here to help. Talk to one of our experts today to find out how you can reinvent your business solutions.