Hitachi Solutions Announces Strategic Partnership with BitBrew

Hitachi Solutions America, Ltd., and BitBrew, are pleased to announce they have entered into a strategic solutions integration partnership.

Read the BlogEnhancing the customer experience through personalization is a leading topic of interest across all industries. Part of that is due to the capabilities of digital information technology and how it allows for the transference of customer data in real time. When organizations are able to get a better picture of their customers, they have better means of providing excellent customer service.

For insurance companies, a major opportunity for improving customer satisfaction and increased efficiency is with telematics and usage-based insurance (UBI). UBI is, essentially, a program for policyholders that calculates and adjusts their rates based on the real-time gathering of relevant information.

A telemetry device can be applied to a vehicle or property to gather all relevant data. Then, through insights based on that data, insurers can better calculate and provide rates that more accurately reflect a customer’s usage — which can result in larger potential savings for lower-risk customers.

Particularly during periods of rising costs and inflation, these potential cost savings provided by a usage-based insurance option could be very attractive to customers. In fact, a 2022 TransUnion survey shows that the number of drivers who would choose to opt into a telematic-based policy is rising, with percentages increasing from 49% to 65% over the past year.

At Hitachi Solutions, we’re working closely with clients who are interested in the potential of UBI and telematics to get started on their own programs. Let’s examine exactly how insurers can benefit from a telematics program and what they need to know to get started.

The State of Telematics

Telematics derives its name from the combination of telecommunication and informatics, which is specific information that is processed through computer technology. While the concept of telematics dates back to the 1970s, modern wireless technology and Internet of Things (IoT) devices have helped to revolutionize telematics systems, especially within the transportation industry.

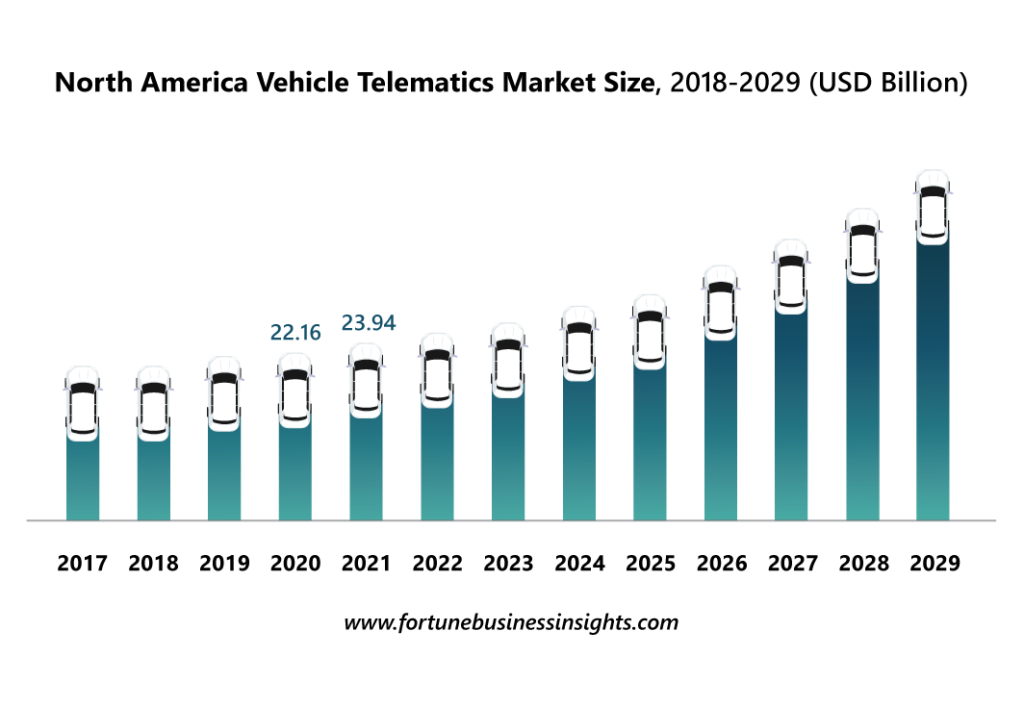

Vehicle telematics has been a game changer for shipping companies, thanks to functions such as vehicle tracking, GPS navigation, wireless safety communication, and automatic driving assistance. Just four years ago there were estimated to be over 100 million telematics units in operation around the world and, according to a Fortune Business Insights report, the fleet telematics hardware, software, and services market is forecasted to continue to grow from a current USD 72.78 billion industry to USD 213.67 billion by 2029.

For close to two decades, vehicle telematics has been employed in fleet management to analyze fleet vehicles to optimize their service and performance. McKinsey presents the example of one trucking company that utilized telematics to gather data on maintenance costs, fuel consumption, depreciation, and other per-mile costs for its entire tractor fleet. The insights derived from this information led to the retirement of its inefficient fleet of vehicles, which reduced operating and maintenance costs to such a degree that the resulting savings more than compensated for the cost of the process.

While telematics has greatly aided shipping companies find efficiencies with their fleets, it is with insurance companies that telematics solutions can further improve the customer experience and provide more personalized services. Here’s how Hitachi Solutions has seen telematics solutions change the insurance industry and how insurances can optimize their telematics data to better serve their customers.

Benefits of Telematics for the Insurance Company

Vehicle telematics can provide the most accurate information about a driver’s behavior and a vehicle’s performance. This includes not just the condition of different parts, but also specific data on average speed in certain locations, or use of functions like windshield wipers, lights, and blinkers. For businesses that employ fleets of truck, this telematics data can be used to:

- Improve the efficiency of fleet management, routing, and dispatch

- Improve vehicle and driver safety and security while on the road

- Provide recommendations for decreasing fuel costs

Telematics devices can even alert drivers if their vehicle has a maintenance issue to protect the car from any further damage. For insurers, this capability to capture data quickly and accurately can allow them to:

- Better identify a risky driver behavior and raise rates accordingly

- Identify consistently safe driving and reward with offerings for lower rates

- Provide flexible UBI rate options that can be more attractive to customers

- More efficiently plan fleet routes

Major insurance carriers are already seizing the benefits of vehicle telematics, as borne out by Fortune Business Insights’ projected high compound annual growth rate for vehicle insurance telematics over the next seven years.

However, telematics isn’t just limited to vehicle operation. In the increasingly popular area of property telematics, the technology allows for greater transparency on what’s going on within a home or commercial property to better inform underwriting and pricing. Property telematics can deliver insurers a real-time data stream about what is happening in a home or business by monitoring the functioning of safety equipment as well as sensitive areas like boilers, furnaces, and water lines.

For example, a warehouse that has highly combustible materials or products needs a sensor for its sprinkler system to detect any potential fire hazards. Such as system would quickly send an alert during a fire and then activate within the specific section – lowering the potential risk of damage. A telematics system would not only detect the presence of a fire-prevention system, but it could also monitor its performance to ensure it is operating correctly.

For insurers, this form of preventative alerts and proactive measures not only makes products more attractive to customers but is also a game-changer for decreasing loss ratios. Not only are risks evaluated more accurately, but there’s also the potential to proactively identify issues and act before they become losses. As telematics increase in ubiquity for property and vehicles, it has the potential for expanding into other areas like watercraft and RV insurance.

How Telematics Improves Customer Experience

The best relationship an insurance company can have with their clients is based on open and clear communication. Clients are always looking for possible discounts, rebates, or refunds. Adopting a UBI program can allow insurers to provide their customers with:

- Alerts about needed repairs or required preventative maintenance, which helps prevent accidents and reduces downtime.

- Coached recommendations for customers to improve safety, reduce risk, and identify efficient operations.

- More accurate and competitive pricing, as well as improved pricing transparency by showcasing how the reduction of risk and improved efficiency reduce costs.

- Greater customization and personalization of insurance based on customers’ needs and performance, resulting in more attractive insurance packages.

- An overall improved customer engagement and a closer relationship with the insurance provider.

Next Steps for Planning a Telematics Solution

Insurance companies that want to keep up with the market need to find ways to deploy their own telematics solutions. As a starting point, they’ll need to consider the required hardware, software, and infrastructure requirements, and how to implement them within their existing platform. However, in order to actually make use of the data, the insurer will need to understand how to capture the telematics data and make it available to both internal and external constituents.

The value of a telematics system depends on an organization’s ability to identify and respond to issues as they emerge. This means that insurance companies must understand the purpose of their telematics program and align on the metrics they want to track and improve. They also need to understand how to formulate decisions based on the telematics data and identify which actions are available to them to drive customer performance improvement.

Here are general recommendations for moving forward with a telematics solution:

- Companies need to train people who can interpret the data, identify opportunities for performance improvement, and make the necessary decisions to capture those opportunities.

- There needs to be flexible and scalable infrastructure support for the development of new smart devices. This also includes compatibility with 5G technology as it becomes more widely available.

- For vehicle UBI, insurers need to be prepared for the future of connected vehicles, where automotive companies design native telemetry within their vehicles. This inherent functionality will display more information about the vehicle’s performance to the driver and insurer.

- For property UBI, insurers will need to consider how to sell to customers on using connected devices like dongles. These devices can be used to sense changes in conditions to warn about floods in sensitive areas or monitor efficient energy usage to provide carbon credits.

Most telematics solutions will assist you with the integration of the required cloud-based technology, mobile workforce management, IoT devices, ERP software, and business management software. However, you’ll need an experienced expert to assist you in utilizing the technology to identify your metrics, analyze your data, and optimize your customer offerings.

How Hitachi Solutions Can Help

At Hitachi Solutions, we provide insurance organizations with the tools they need to ingest, analyze, and present telematics data. Carriers can then use these data-driven insights to support business objectives. Will your metrics be weighted toward how your clients drive within the five-mile area of their house or more be concerned about their speed on interstates and highways? Will your customers be open to accepting a dongle in their vehicles, or do you need a system that works from mobile device data?

We’ll assist you in evaluating your hardware options, how you can collect and analyze your data, and how to best develop the algorithms and machine learning you’ll need to develop insights. Our extensive insurance background and our partnership with a telemetry provider allow us the expertise to guide you along your usage-based insurance journey.

Read more about how our partnership with BitBrew and their Connected Vehicle Platform is accelerating the telematics solution journey for our customers

If you’d like to learn more about how telematics can power your usage-based insurance, contact us and consult with our experts.