Digital Transformation Playbook

Is your business ready to reimagine how it operates?

Download the EbookA Guide for Digital Leaders Looking to Implement Change

Introduction

Financial services organizations are at a transformational tipping point. Faced with fierce market pressures throughout the industry — nimble disruptors, complex regulations, digital native customers, and the fallout of a global pandemic — technology transformation is no longer merely a competitive advantage, but an absolute necessity. Put simply, the widespread adoption of cloud computing and big data analytics, new and emerging forms of engagement, and evolving customer expectations are changing the financial services landscape. Firms leading the charge into this new era are reimagining the customer experience, fostering a new culture of work, optimizing operations, and driving product innovation. They are doing this by utilizing advanced technical and analytical infrastructures that are extensive, scalable, affordable, and able to analyze and manage big data in a timely manner to keep pace with the demands of digitally savvy customers.

For some time now, technology has been able to combine an IT ecosystem with relationship and financial management software, along with an advanced analytics infrastructure for predictive analytics and machine learning — all connected over a common data platform on a common database. In an industry where business processes can be diverse, implementing a single ecosystem across multiple lines of business can be transformational, helping financial services organizations enhance profitability, increase revenue, optimize investments, and position their business for long-term growth.

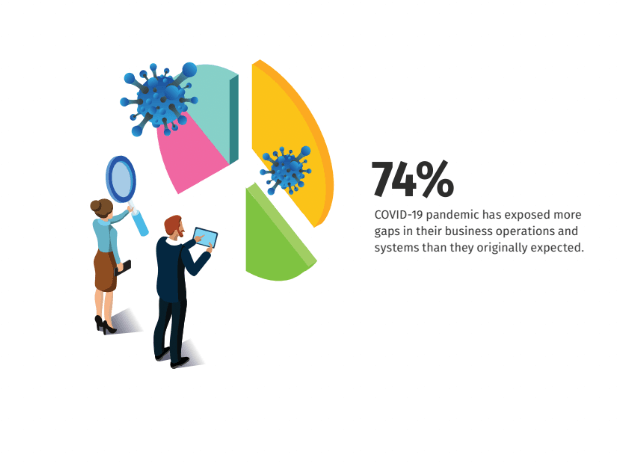

Organizations that fail to recognize this opportunity risk falling behind, as do those that overestimate how digitally advanced they are. According to a global study, 74% of business decision-makers in the financial services sector say that the COVID-19 pandemic has exposed more gaps in their business operations and systems than they originally expected. Of those surveyed, 71% report that this experience has forced them to accelerate their digital transformation plans; 62% state that they will increase the priority level of digital transformation within their organization; and 56% say that they will add to their digital transformation investment.

The importance of a digital transformation strategy cannot be understated. For any CEO or C-suite executive, awareness is the first step. Developing and executing a plan that your leadership team can implement to address the required updates to culture, systems, and capabilities — and that can grow and adapt to changes within the financial services landscape — is the second step. In this post, we will discuss the benefits and impacts of digital transformation for the financial services sector and offer advice on how to accelerate change within your organization.

The Financial Services Industry Landscape

Where We Are & Where We’re Headed

Much has changed over the past few years in the financial services sector. As recently as 2017, organizations still took a reactive approach to operational optimization, one that maintained the status quo rather than improve competitive performance. It wasn’t until 2018 that the industry experienced a sea change:

- Once an emerging technology, cloud computing had become the new status quo

- Analytics made it possible to unlock the latent potential within operational and customer data

- The rise of the digital economy presented organizations with the opportunity to expand into new markets

As a result, financial services firms pivoted from a reactive position to a proactive one, leveraging new technologies as a means of fueling innovation and driving long-term, sustained growth.

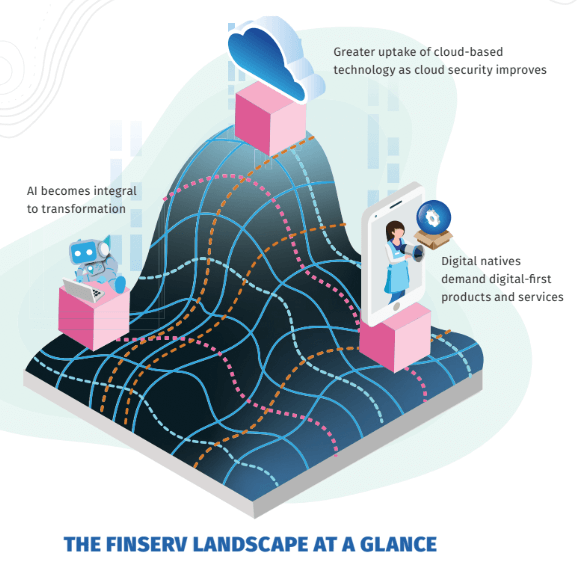

Which brings us to today. We’re seeing continued momentum toward the cloud and modernization as a whole, driven by the need for resiliency, an industry-wide shift toward customer-centricity, and the urgency to both reimagine existing products and introduce new ones in order to maintain a competitive edge.

Let’s look at other contributing factors behind this renewed emphasis on digital transformation:

THE CLOUD

Online and mobile banking, for instance, have drastically reduced the need for brick-and-mortar banks, with the number of physical branches dropping from 94,725 in 2014 to 88,075 in 2018. The COVID-19 pandemic has only accelerated this trend, as banks were forced to shutter branch locations due to safety concerns. The emergence of fintech has bred several new players looking to compete with traditional financial services organizations. From payment processing to alternative lending to automated investing and wealth management services, consumers’ options are now greater than ever, and only a click away. Not only do many of these new fintech players offer convenience and a host of features for consumers, but they were also built on the cloud from day one, meaning they are able to innovate more quickly than traditional organizations.

Traditional financial services organizations have been slow to move to the cloud due to security and privacy concerns in a strictly regulated industry. This hesitation has been a barrier to change for many financial organizations that have been working within the constraints of legacy technology. More recently, cloud providers have been able to offer greater assurance that data is protected and secure — creating an atmosphere more hospitable to financial services organizations.

“Risk-averse banks […] are warming to the fact that the big cloud providers can spend more on security in a month than any bank could spend in a decade,” says Eve Aretaxis, chief revenue officer of ACI Worldwide, a leading provider of real-time payment solutions.

Banks aren’t the only ones warming up to cloud-based solutions; insurance companies are also reaping the rewards. Thanks to cloud computing, insurers are able to invest funds that they normally would have spent maintaining their own physical servers and purchasing additional computing resources into launching new products and services, developing more scalable service delivery models, and accelerating their Go-To-Market. Cloud-based solutions also provide insurers with greater business agility, enabling them to be nimble and pivot to accommodate rising consumer demands and larger shifts in the market — a vital necessity in this rapidly changing landscape.

DIGITAL NATIVES

Once just a small segment of the population, Millennials now outnumber both Baby Boomers and Generation X, with Generation Z on track to surpass them. What this means for businesses everywhere is that the vast majority of their prospective customer base are now digital natives — that is, people brought up during the digital age and comfortable with using the internet and other various forms of technology. This rapid change in demographics has contributed to the transformation of the financial services industry, causing firms to rethink how they market and sell to this largely online audience. Given the prevalence of social media — 82% of the U.S. population report to having at least one social networking profile — it has become a powerful tool that financial services organizations can leverage to shape their brand identity, market new products, engage with customers, and more.

Once a small segment of the population, Millennials now outnumber both Baby Boomers and Generation X, with Generation Z on track to surpass them.

Beyond social media, digital natives expect their banks and insurance providers to be as technologically savvy as they are. For evidence of this, look no further than fintechs, which have gained significant market share due to their use of innovative technologies, such as artificial intelligence(AI), biometrics, blockchain, and digital payments. In almost all cases, these systems are designed to optimize the customer experience by making it faster and more convenient — two qualities that digital natives prize. If traditional financial institutions are too slow to adopt a digital transformation strategy and adapt to the buying behaviors of this new, young cohort, they could find themselves irrelevant in an increasingly digital-first world. Those that do retire legacy systems and infrastructure in favor of digital platforms will find that they’re not only able to accommodate the expectations of Millennials and Gen Z — they’ll also put themselves in a winning position to adapt to the needs of future generations.

ARTIFICIAL INTELLIGENCE & ADVANCED ANALYTICS

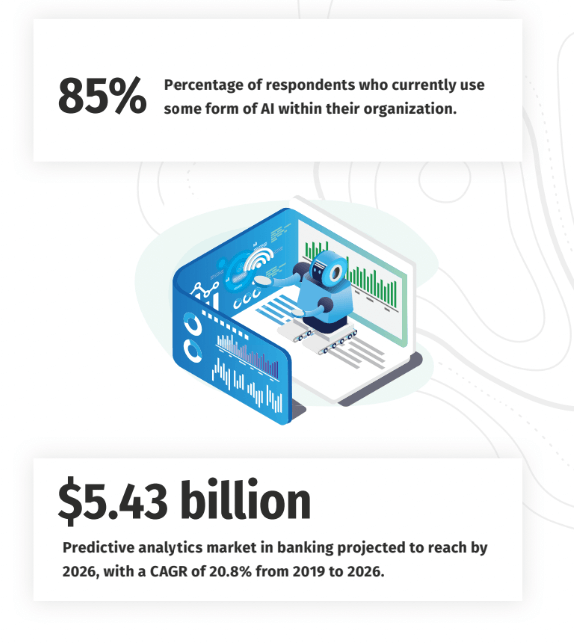

According to a global survey of financial institutions, 85% of respondents said that they currently use some form of AI within their organization. And, according to a recent report, the predictive analytics market in banking is projected to reach $5.43 billion by 2026, with a CAGR of 20.8% from 2019 to 2026. When taken as a whole, these findings demonstrate the widespread adoption of both AI and advanced analytics within the financial services sector — a trend that continues to grow with each passing year.

It’s easy to understand why: From automated fraud monitoring and credit risk analysis to AI-enabled customer service and personalized recommendation engines, there are seemingly endless applications for these technologies. Through adoption and innovation, banks and insurance providers have been able to enhance the customer experience, optimize existing processes, anticipate and mitigate potential risk, and deliver more valuable products and services.

Regardless of whether your organization is just beginning to experiment with AI and analytics, or you were an early adopter and are now looking to expand into new areas, a digital transformation strategy is absolutely essential. Only by developing such a strategy can you ensure that you have the right people, processes, systems, and culture in place to support and maximize your investment.

According to a global survey of financial institutions, 85% of respondents say that they currently use some form of AI within their organization.

The need for change is evident, now more so than ever. Following the events of 2020, it’s become painfully clear that digital transformation not only offers financial services institutions a competitive advantage — it has the power to accelerate recovery in the wake of global disruption. Organizations that had developed a digital transformation strategy prior to the COVID-19 pandemic proved that they were more agile, able to pivot in accordance with changing consumer needs. “There is a digital divide,” said Jerry Silva, global banking research director at IDC. “Sometimes I call it the predatory gap, because those banks are going to be able to steal market share from those that weren’t prepared prior to 2020.”

There is a digital divide. Sometimes I call it thepredatory gap, because those banks are going to beable to steal market share from those that weren’t prepared prior to 2020.

If there’s one clear takeaway from the current state of the financial services sector, it’s this: Any institution that wants to still be here tomorrow must embrace digital transformation today.

The Digital Transformation Strategy

Six Key Areas of Focus

INFORMATION & INSIGHTS

Gathering data is just the first step; it’s what you do with it that really matters.

In order to leverage customer, operational, and market data to its greatest effect, financial institutions must first consolidate it within an enterprise data warehouse. Data warehouses and master data management make it possible to pull data from numerous different sources into a single, centralized repository, breaking down departmental and even line of business silos in the process.

Once securely stored within a data warehouse, an organization can then apply enterprise reporting and analytics and build statistical models using machine learning concepts in order to extract meaningful insights from various data sets. With these insights comes the power to optimize existing products and services, identify opportunities to increase market share, develop new pilot programs, and, of course, enhance the customer experience.

Consolidating multiple data resources and then extracting insights from that data are core components of building a modern data estate — that is, a highly sophisticated infrastructure that enables financial services institutions to ingest, manage, and strategically leverage data in real-time.

DIFFERENTIATED EXPERIENCES

One of the primary drivers of digital transformation is the ability to better engage with and meet the needs of the modern consumer. This is often easier said than done, given rapidly changing customer expectations and the pressure that financial institutions face to deliver better products and services at speed, all while maintaining a cohesive customer experience across multiple channels. Speaking of channels, customers now operate across more than ever before. According to a report from McKinsey, 71% of consumers in the financial services sector prefer multichannel interactions. Additionally, the use of online and mobile banking channels increased by 20%–50% within the first few months of COVID-19 and is expected to remain a strong trend for the foreseeable future.

As far as customer engagement and satisfaction are concerned, the secret to success in the increasingly competitive financial services market is to deliver personalized solutions and experiences that make each customer feel like they’re your only customer. It all starts with a 360-degree view of the customer based on data aggregated from multiple digital touchpoints. This comprehensive view not only helps you to better understand who each customer is, what they want, and what matters to them — it also enables you to figure out where they like to spend their time and how they prefer to engage with your organization.

A customer relationship management (CRM) system is a valuable tool for establishing a 360-degree view because it empowers you to create a centralized database for consumer data and further segment that data into individual customer profiles. Armed with insight, information, and context, financial institutions can develop targeted marketing campaigns that speak directly to the consumer and deploy them through the appropriate channels — that is, where that particular consumer is most likely to see and engage with them.

Firms can also leverage CRM data to optimize existing processes and products, develop new products that better serve their target market needs, and design applications that fill gaps within the user experience. Ultimately, utilizing customer data in a smart, strategic way can enable financial institutions to build unique, customer-facing digital experiences that set them apart from the competition.

UNIFIED OPERATIONS

Thanks to the digital tools and capabilities that are now available —including CRM systems, ERP systems, and customer service solutions— financial services organizations now have the ability to improve collaboration, increase decision-making speed, develop and produce new products, and gain greater visibility into their entire operation.

Unifying operations within a connected ecosystem is a foundational step along the digital transformation journey, one that enables financial services organizations to access real-time data, customer insights, and continuous feedback in order to enable predictive, data-informed outcomes and optimized operations. With the ability to access and execution on real-time data, financial institutions are able to make intelligent,data-driven decisions and become more agile, like their FinTech industry disruptor counterparts.

For banks, insurance companies, and capital markets, unified operations present new opportunities not only to optimize, but to modernize — a true transformation that enhances their ability to attract new customers, streamline onboarding, manage risk across portfolios, and more. Ultimately, unified operations enable financial institutions to gain greater visibility across their organization, move at a more rapid pace, and accelerate business through new opportunities.

ORGANIZATIONAL PRODUCTIVITY

Remote employment in the financial services sector is on the rise. Though the initial shift to remote work was precipitated by the pandemic, 74% of CFOs and finance leaders now report that they plan to move at least 5% of their previously on-site workforce to permanently remote positions post-COVID-19. In order to make this transition as smooth as possible and ensure continued organizational productivity, firms must make every effort to foster collaboration and communication between team members located at all corners of the world.

This massive shift to remote work also raises valid security concerns. According to a study conducted by the Ponemon Institute, 70% of financial services firms fell prey to a successful cybersecurity attack in 2020. A follow-up poll showed that over half of respondents (57%) believe that cyberattacks are increasing in severity due to remote work, citing the lack of physical security on remote workers’ devices.

The good news is that modern workplace solutions are capable of delivering the collaboration and communication that firms need to support a fully remote or hybrid work model while holistically addressing data protection and security requirements. For example, the video conferencing, group chat, and content sharing capabilities found in Microsoft Teams make it easy for remote employees to collaborate on projects in real-time. Financial institutions can also create their own custom-built communication and collaboration applications using Power Apps. On the security side, AzureVirtual Desktop enables remote employees to securely access their desktop and applications from virtually anywhere in the world, while Azure ActiveDirectory safeguards sensitive company data through single sign-on and multi-factor authentication-based access management.

74% of CFOs and finance leaders plan to move atleast 5% of their on-site workforce to permanentlyremote positions.

MODERN INFRASTRUCTURE

True digital transformation is impossible without a truly transformational platform to support it. That means migrating application and data environments from outdated legacy systems and on-prem infrastructure to a centralized, modern platform in order to realize the benefits of the cloud and cloud-scale analytics.

Through cloud migration, financial institutions have the opportunity to align with industry standards and best practices, enhance customer agility, optimize performance and integration, and improve compliance, controls,and security. Without the cost and inefficiencies of on-prem infrastructure— including operational and maintenance costs — organizations are free to explore new opportunities that empower employees, delight customers,and deliver new business value.

Firms that choose to invest in managed services reap additional rewards, including IT expertise from a team of highly qualified professionals and the ability to scale up or down as needed, enabling them to focus on business-critical objectives and avoid costly downtime.

ENHANCED CAPABILITIES

In the financial services sector, as in all industries, digital transformation isn’t simply technological — it’s cultural. New systems and solutions may boast all of the advanced capabilities in the world, but without executive buy-in and user adoption, the needle of innovation cannot move forward.

In order to move forward in their digital transformation journey, financial institutions must create a culture that fosters talent and ingenuity, facilitates cross-team collaboration, and encourages employees at any level of the organization to make decisions and contribute ideas. With such a culture in place, firms can finally realize the benefits of their technological investment as employees feel confident and empowered, able to provide customers with the highest level of service.

Discover Digital Compass

When it comes to financial services, customer expectations have changed, and they will continue to do so as technology evolves. That’s why digital transformation requires disruptive thinking.

Hitachi Solutions’ Digital CompassTM provides a practical playbook — one that incorporates the six key areas of focus necessary for digital transformation — that enables financial institutions to innovate quickly and with high quality, elevating team members along the way. We do so by combining the power of the Microsoft platform with our own deep industry expertise and all-cloud capabilities to help financial leaders take their firm’s digital transformation journey from strategy to reality. With thousands of engagements under our belt, we’re able to deliver real, repeatable results for each and every one of our banking, insurance, and capital markets clients so that they can reimagine the way their company operates and seize new growth opportunities.

Make your transition with confidence.