Digital transformation is impacting nearly every industry, from healthcare and manufacturing to transportation and finance. The insurance world is no exception.

As consumer expectations grow in terms of service and accessibility, the insurance industry has had to evolve and expand to meet those expectations. It’s all about speed, efficiency, and accuracy.

All of this has led to the growth and evolution of what is now known as digital insurance. To become and remain competitive in a marketplace as crowded as insurance, carriers must have robust digital capabilities.

The idea of shifting such a complicated business operation to meet the demands of digital consumers can seem overwhelming. However, the advancement of technology today has made this seemingly daunting task something manageable and achievable. This guide to digital insurance will help steer you on the path to a successful and profitable digital transformation.

A Guide to Digital Insurance

First things first – what exactly is digital insurance? Is it just having an online portal? Is it a robust analytics system that uses AI? Is it just the insurance companies that operate solely online? The short answer is yes, all of the above. But digital insurance is so much more than that and is continuing to grow.

For our purposes, digital insurance is an all-encompassing term. It is more strictly defined as any company using a technology-first business model to sell and manage insurance policies. However, as we know now, any insurance company that wants to compete for even a sliver of market share must check all the boxes.

To be a top-performing insurance company, you must have a digital component and a digital customer-facing arm of your business. Online and the digital world is where your customers are, and you must meet them there.

Digital insurance is also a case of consumers wanting their cake and eating it too. They want digital touchpoints where they can get service when and where they want, but they still expect to be able to access customer service when they need it. This is why digital insurance is so much more than just an online presence, it is an all-encompassing level of service.

Digital Insurance Tools

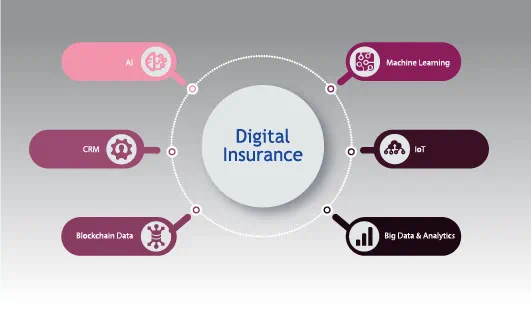

To deliver this level of service and the full suite of digital capabilities customers expect, there are certain tools insurers must have in place. These digital tools serve both the customer-facing and internal sides of the business, while also providing invaluable data and insights that serve all areas of insurance operations.

So, what are some of these tools that companies need to have to properly interact with customers and truly be a digital insurance company?

- Artificial Intelligence

- Machine Learning

- Internet of Things

- Big Data & Analytics

- Blockchain Data

- CRM (Engage)

Artificial Intelligence (AI)

Artificial intelligence is an incredibly broad term, and its capabilities continue to grow and change on a seemingly daily basis. Today, the biggest benefit of AI in digital insurance is its ability to expand and enhance customer-facing programs, enabling them to provide that “personalized” experience at the speed of digital technology. This will only further improve an insurer’s customer service branch and its employees’ ability to service customers quickly and accurately. Something as simple as an AI engine that alerts an agent when the sentiment of an email is negative can go a long way with customer service.

PricewaterhouseCoopers released a report that outlined their forecasted impact of AI on the insurance world. They believe it will help insurers to automate the underwriting, pricing, and claims processes, before eventually expanding its capabilities to include identifying new business opportunities, identifying instances of fraud, and even preventing attrition of current customers.

Machine Learning

According to Forbes, “Machine learning is technically a branch of AI, but it’s more specific. … Machine learning is based on the idea that we can build machines to process data and learn on their own, without our constant supervision.”

While machine learning is essentially a sub-section of AI, for digital insurance it also helps to serve a very different purpose. The insurance industry is highly dependent on data and data analytics. These statistics inform everything from underwriting to claims to pricing, and machine learning will help insurers do all of these things more accurately and more quickly. A good use case for Machine Learning is letting the engine run against large amounts claims to start recognizing fraud patterns that would be much harder for humans to detect.

Internet of Things (IoT)

While IoT has been around for a long time – think wearable technologies and smart home devices — it has only recently become a tool used by insurance companies. Its capabilities aren’t necessarily a “must-have” feature of digital insurance, but one that customers and companies alike are looking for, albeit for very different reasons.

Many insurance companies use IoT to collect data on customers (who have opted in to said program) in an effort to incentivize good behavior and safe practices. Progressive offers customers a monitoring device that rewards them for safe driving behaviors, while the company gets to collect more data that will inform policies and underwriting for years to come. If customers are willing to share data and insight on their lives to save on insurance, it’s a win-win situation for each party. Another benefit to both policy holders and carriers can be devices that alert based on trauma such as a flood detector in the laundry room.

Big Data & Analytics

It cannot be emphasized enough – the insurance industry needs to leverage data, and lots of it. One of the many upsides of digital insurance is its proliferation of data and data sources, making big data and analytics a key tenet of digital insurance and insurance companies.

Big data can be used to inform everything from underwriting policies to marketing plans. Insurers can use other tools in the digital insurance world – such as predictive analytics, machine learning, and AI – to best leverage this data into actionable insights for their adjustors, salespeople, and overall operations.

Blockchain Data

Blockchain data is difficult to describe, but it is essentially a chain of peer-to-peer data records that are incorruptible. These records are known as blocks, and each block links to a previous block with a timestamp and code, enabling it to be incredibly safe and secure.Blockchain makes cryptocurrencies like Bitcoin possible, but you might be surprised at the role it also can play in digital insurance.

Insurance experts forecast that blockchain data will impact digital insurance in four primary areas of operations:

- Consumer trust

- Improve efficiency

- Better claims processing

- Fraud detection/prevention

CRMs

You likely already have a customer relationship management system in place, but does it support a digital insurance operation? To meet all of the demands in the digital insurance space – customer self-service, adjustor portals, online billing, data analytics, and more – you need a CRM optimized for these functions.

At a minimum, an insurance CRM should give you the ability to do certain tasks expected of insurers by customers such as viewing a single pane of glass of customer information. Live chat and video sharing are valuable tools for both adjustors and customers. A digital insurance CRM should also feature a robust, holistic portal that customers can use to report claims, pay bills, see their policies, check their coverage, and even video chat. This customer-facing functionality is arguable the cornerstone of digital insurance, and a good CRM will help you check all of those boxes.

From an internal standpoint, a good CRM can empower employees to do their jobs better, tackling more tasks with tools like broker reporting and producer productivity. These two functionalities specifically arm adjustors, salespeople, and marketing team members with data, support, analytics, and a comprehensive dashboard to work across lines of business and take insurance business ops to the next level.

Why You Need Digital Insurance

You already know you need digital insurance capabilities to remain competitive in the insurance marketplace. But how will it actually help you attract customers and build business? Here are five primary reasons you need digital insurance:

- Customer Expectations/Customer Service Consumers today expect instant gratification – service when they want it, on any device, in a seamless experience. They also expect personalized attention and assistance when they need it. Digital insurance capabilities such as online portals for customers and AI allow insurers to do all these things, and more.

- Speed to Market It’s likely obvious that a digital solution is easy and faster to deliver to market. But speed to market in digital insurance applies to more than just new products; it also means speed to service customers, speed to reach new customers, and speed to work across new channels.

- Fraud Detection According to the FBI, the total cost of insurance fraud is estimated to be more than $40 billion a year. While not all fraud can be eliminated, digital insurance tools such as AI and advanced analytics can identify patterns, out-of-place behavior, and even mine social media data in support of fraud detection practices.

- Employee Experience Digital insurance programs like CRMs give employees in the insurance industry invaluable tools and insights. Digital capabilities offer a 360-degree view of the customer that helps reps do anything they might need to do with or for a customer, wit be writing policies, processing claims, or taking payments.

How to Transform to Digital Insurance

To transform operations and function as a digital insurance company, you need to implement a complete customer engagement platform, one that features all of the aforementioned tools and functionalities.

Hitachi Solutions helps insurers utilize the latest advances in technology to transform their business models, drive growth, and meet evolving consumer expectations by being a one stop shop for everything the Digital Insurer needs. We offer services for CRM tools, Custom apps, Advanced Analytics (including AI and Machine Learning), and more and have helped other organizations achieve true digital transformation . As insurers look to move away from legacy systems and modernize operations, Hitachi Solutions can help forge the path forward. With on-premises and cloud capabilities, we can help your insurance organization modernize your core systems for optimized operations.

If you want to learn more about the capabilities of Hitachi’s digital insurance offerings, or how our Engage for Insurance tool will help you put your customers first, reach out to our team today.