We’ve looked before at how digital technology is changing the insurance industry, from policy writing and processing claims to the customer experience, through innovations such as automation, data analytics, and artificial intelligence (AI). In this blog, we’re going to dive deeper into what these digital advances mean specifically for underwriting — an essential component of performance for both casualty and commercial property insurance that is set to see some big changes.

Advances such as AI automation in insurance underwriting have major implications for the entire underwriting process flow, from data collection to finalizing policy pricing. In truth, out of all the roles in insurance, underwriters will arguably see the greatest amount of industry disruption due to technology. Underwriters will need the tools and support to adapt to significant changes with insurance underwriting technology if their operations are to meet rising agent, business owner, and customer expectations.

If you’re concerned about how these technologies might disrupt your industry — or eliminate underwriting jobs — understand that the larger concern should be about what happens if you aren’t keeping pace with these changes, as the competition gets faster, more accurate, and more profitable.

The Need for Modern Insurance Underwriting Technology

The impact of technology such as digital underwriting can’t be overstated as underwriters serve as the connection between sales and policy writing. Having access to the latest tools, such as advanced data analytics, has become table stakes for the insurance industry. Here are just some of the reasons why:

- Intense price competition continues to erode value across the industry, to the point that margins for turning a profit are growing increasingly smaller, necessitating greater accuracy in underwriting.

- At the same time, increased market pressures are forcing underwriters to be more efficient, with faster turnaround times on a larger number of assessments. In a market where some providers promise an instant quote for as little as your name and address, insurance companies need to be able to pull as much data for analysis as quickly as possible to stay competitive.

- More disruptions and greater risks threaten to further complicate risk analysis. The COVID-19 pandemic and subsequent downturn were major sources of recent disruption. Looking to the future, natural catastrophes will become more frequent and more severe due to the ongoing climate crisis. Insured losses in 2021 for natural catastrophes totaled $130 billion, which was 76% above the average for the 21st century.

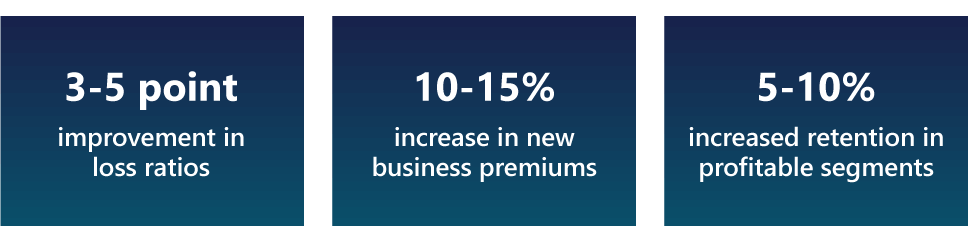

Modern data collection, automation, and analytics are essential for meeting these challenges. According to a McKinsey report on data and analytics in underwriting, “leading insurers can see loss ratios improve three to five points, new business premiums increase 10 to 15 percent, and retention in profitable segments jump 5 to 10 percent, thanks to digitized underwriting.”

Aside from the potential revenue benefits, digital technology such as AI can serve as a point of distinction, helping an insurance provider stand out from those that lag behind in adoption. Insurers can highlight their digital underwriting transformation by promoting the speed, insights, and accuracy made possible by automating routine tasks, pulling more data from alternative sources, and augmenting their underwriting teams with AI-generated insights.

Though this shift is sometimes characterized as a disruption, in truth these tools are a long time coming: the result of an evolution in new technologies and shifts over time in the underwriting process.

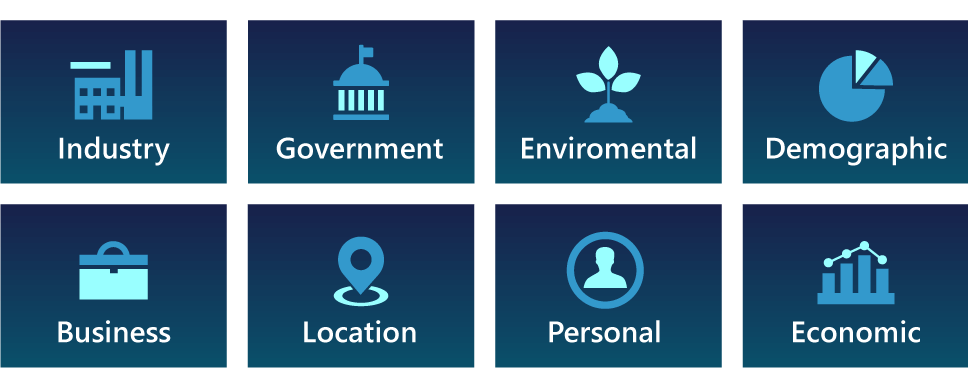

Some of the major external data domains driving modern analytics

The Rise of Underwriting Automation

Digital technologies have automated many relatively low-value manual tasks in insurance, and the underwriting process is no different. The insurance industry has used PC-based automation systems since the early 1980s. Automation has enabled underwriters to communicate more quickly and effectively with agents, brokers, and policyholders. It has also freed them from menial tasks such as data entry to take on higher-value work, such as deeper analysis or product innovation.

Risk assessment has also evolved greatly over time thanks to advances in underwriting technology. Just as modeling and automated evaluations replaced the earlier binary logic used for knockout scoring, they were succeeded by even more robust risk-profiling techniques such as pattern matching.

Big data has further changed what’s possible for enhancing risk assessment. Insurers now have access to more third-party data than ever before, ranging from open sources of public data such as government records and environmental conditions to industry- and business-specific records. Current estimates put the amount of data generated daily to be 180+ zettabytes by 2025, or over 180 quintillion megabytes.

Predictive analytics technology helps insurers distill that data — which, in turn, enables underwriters to proactively evaluate risk . This move from reactive to proactive has changed the rules of the game within underwriting, allowing for active monitoring of portfolios and immediate updates to a carrier’s book of business.

Today, personal lines — home, auto, and the like — can have accurate quotes generated in historically short amounts of time, even down to just seconds. Commercial lines aren’t quite at that level of turnaround just yet, but AI analytics does enable underwriters to better meet customer expectations through more accurate and timely quotes.

The Future of Underwriting

A common concern among professionals about emerging technologies such as AI is that their employers will use it to replace them, resulting in fears about job security. The truth is that people who aren’t using AI are the ones most at risk of being replaced because they will be unable to adapt to the changing nature of their jobs.

Rather than being displaced by automation, underwriters can grow within their positions by building greater value for the insurer. By learning new skills and incorporating new digital tools into their process flow, underwriters can automate manual tasks and increase efficiency and productivity. For example, they could bring about any of the following benefits:

- Instant incorporation of added data points. The last few years have seen the rise of added considerations such as consumption and utilization for policies. Telematics increasingly provides real-time updates about clients, for everything from how individuals drive for a car insurance policy to operations within a building for property insurance. While this allows for greater policy customization and more accurate assessment of risks, it’s a heavy lift to bring in so many data points. With automated processes, the introduction of new data inputs can be much less of a burden.

- Simplified application process for customers. The availability of more public data fills in many of the blanks for a policy, making the application process less onerous for consumers. For example, insurance companies can get financial ratings on a business based on their publicly available stock ratings.

- More accurately priced risk. AI-generated insights can make it easier for an underwriter to look at a policy and see if the premiums match up to the policyholder’s liabilities, expenses, or payments. AI can also easily highlight areas of potential growth or quickly identify products that are lagging in growth, leading to greater profitability.

- Greater consistency across underwriting decisions. AI can also help to better identify risk factors and other variables across a vast number of applications, helping to make the underwriting process not only more accurate, but also more consistent.

Podcast: Future of the Underwriter

Underwriters and actuaries have had their roles dramatically impacted in recent years. Join our industry experts as we explore the challenges of copious amounts of data, changing market and consumer expectations, advancements in technology, and types of insurance policies being sold.

Listen to the podcast now!Future Roles of Underwriters

Admittedly, by introducing these efficiencies much of the traditional work of underwriting becomes automated. However, rather than displacing underwriters, AI automation enables them to play more specialized — and higher-value — roles. Depending on what’s needed, they may act as a custodian of the underwriting process or be more active as a decision-maker in business decisions. Here’s a breakdown of some of the ways the traditional role of an underwriter could be redefined:

- Decision scientist — The underwriter works with data scientists as a co-developer of newer and more advanced analytics tools. They specialize in utilizing data insights to inform the sales team on what to communicate to agents, brokers, and customers. They will also assist in identifying cross- and upselling opportunities and in negotiating alternative terms and conditions to close sales.

- Data innovator — The underwriter works directly with IT and data scientists to design, develop, and implement analytics and predictive models to improve underwriting and pricing accuracy. They’re experts on how models select or price risks and are called on to defend decisions from challenges by distributors, clients, and regulators. They also train their underwriting peers on how to communicate data-driven advice to other departments and customers.

- Customer advocate — The underwriter focuses on supporting the customer experience by building and maintaining collaborative tools that all departments can use. They may prioritize accounts servicing based on metrics such as cost of delivery, type of service, method of service, and customer needs. They collaborate with others on the account team to provide real-time advice and expertise through all available customer channels.

- Digital manager — The underwriter manages the digital workflow by supervising the insurer’s automation programs and looking for ways to improve operational efficiency. They work closely with IT to update the underwriting platform by implementing new rule sets and running tests to verify accuracy and check performance.

- Business builder — The underwriter works to build closer and lasting third-party relationships in an effort to offer differentiated services that can de-commoditize capacity. The underwriter finds ways to seamlessly incorporate those services into the insurer’s underwriting value proposition.

- Risk detective — The underwriter specializes in risk assessment and works to improve the identification of potential risk events to mitigate their impact or avoid them entirely. They assess exposure probabilities at a case level to offer better exposure foresight to customers.

Relevant roles will depend on an organization’s internal teams, customer composition, lines of business, distribution channels, and market strategies. To determine which roles will best fit within an organization, insurers should consider both their larger needs and the unique skills and personalities of their underwriters.

Adopting these new roles — and the technologies that support them — will take an investment of time, money, and training. However, the insurers that are reluctant to consider these redefined roles are likely to fall behind their competitors, have a harder time recruiting and retaining skill underwriters, and may even drop off the preferred lists of their distribution partners.

How to Achieve Digital Transformation in Underwriting

Underwriting will never be fully automated because the role will always require an element of human judgement. Purely rules-based underwriting can’t fully account for shifts in the market — such as the emergence of new risks and the resulting need to adjust coverage and pricing — or address all the needs of partners and clients.

Optimal performance will come from underwriters who can incorporate digital technology such as analytics and AI into their processes and utilize their experience and judgment to adapt to changing market conditions, build and maintain relationships, and manage the delicate balance of coverage and pricing. Insurers looking to implement a digital transformation should consider the following steps:

- Incorporate new data sources — Big data is constantly expanding, and so insurers will need to be on the lookout for new sources of data that can inform risk assessment. For example, changing climate conditions are likely to complicate commercial property risk assessment, while the proliferation of wearable deceives offers new data points for health or life insurance.

- Automate processes — It’s already established that AI automation can process repetitive tasks more efficiently and cut down on manual processes. However, AI can also automatically assist underwriters in determining ratings. Conversational AI agents can also provide real-time assistance and support communication between different stakeholders.

- Utilize the cloud — Cloud computing helps insurers move away from outdated mainframe or legacy systems that keep data locked in silos. Modern cloud systems can create a more seamless experience for underwriters by offering a single platform where they can access, merge, and generate insights from data drawn from multiple sources.

- Incorporate tech strategically — Implementing new tech without a strategy for how to transition employees and processes is a recipe for disaster. A successful implementation requires careful consideration of how the underwriting role will actually use the technology. Start your transformation small to better manage the process, learn from its implementation, and earn buy-in. For example, new processes could be applied to two different lines of business, each with different levels of performance, to showcase impact.

- Offer the right training — Don’t assume underwriters will be able to jump right into these new roles. Underwriters will need to build a mix of skills and capabilities depending on how their roles will change. One may need more training in analytics, another in collaboration with sales and relationship-building.

Insurers that invest in modernizing their underwriting technology, while equipping their talent with the right skills and training, stand to empower and engage their underwriters, build customer loyalty, and reduce costs. Aside from integrating technology, the most important step insurers can take to position their underwriters for success is to help them understand how this technology can be deployed and integrated into existing processes.

Take the Next Step with Hitachi Solutions

Choose a partner with extensive experience and insurance industry expertise with the tools that enable the digital transformation of underwriting. Hitachi Solutions partners with insurers in implementing platforms such as Outlook, Dynamics 365, and the Power Platform into their existing operations. We even created a streamlined method of rapidly centralizing data sources in our Empower Data Platform to enable our customers to make strategic business decisions through synthesizing the data that drives your analytics.