Customer Data Platforms: Solving the 5 Key Business Challenges in 2023

This comprehensive guide unpacks the potential of Customer Data Platforms (CDPs) in meeting key business challenges, providing you with in-depth case studies, insights on data governance, and a roadmap for responsible AI integration.

Download the WhitepaperHave you ever received two pieces of mail from your bank — one addressed to you and the other to your partner — with the same offer? If you have, you know how the story goes: One of the mailers inevitably ends up in the trash or recycling, and you’re left puzzling over why any bank would waste its marketing resources on duplicate content.

If any of this sounds familiar, then you’re already familiar with the need for householding.

What is Householding?

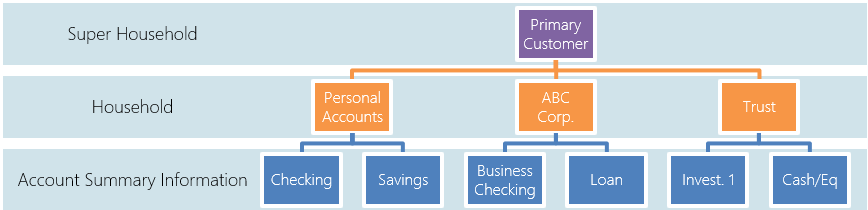

Simply put, householding refers to the process by which banks group customer accounts into “households” based on their preexisting relationships with one another. For example, a household might consist of a married pair, or a family with adult children still living at home, all of whom have accounts at the same bank. The purpose of this is to enable banks to identify meaningful relationship dimensions between customers, such as bank deposits, loans, and investments, as well as discover opportunities to upsell and cross-sell products at a household level. Householding is similar in nature to master data management, but householding is more advanced.

There’s even a subset of householding designed especially for businesses. Known as superhouseholding, it involves identifying the beneficial owner of a business (known as the primary customer) and determining the bank’s exposure to them.

For a visual breakdown of the standard householding structure, take a look at the graphic below:

What are the Benefits of Householding?

We’ve already addressed a few of the benefits of incorporating householding into banking strategy; other benefits include:

- Householding allows for more granular customer segmentation by enabling banks to add detailed information about account relationships to customer profiles.

- Householding enables banks to develop targeted, data-driven marketing campaigns and offer them to the proper segments, both from an individual and business customer perspective.

- Householding makes it easier for banks to identify next actions and next best product recommendations based on the relationship between customer accounts.

- Householding enables banks to personalized messaging and service offerings, which enhances the customer experience.

- Householding supports omnichannel enablement by providing banks with data-driven insights into customers’ channel preferences and behavior.

- Householding helps banks discover potential risks within relationships, which supports more efficient risk management and mitigation.

- Householding simplifies new account onboarding and setup, as well as the loan underwriting process, by automatically pulling data from existing, related customer records.

- Householding prevents customers within the same household from receiving multiple identical offers, which can be off-putting and alienating.

What are the Challenges of Householding?

Although there are many benefits to householding accounts, it’s impossible for banks to realize those benefits without the proper technology in place. Legacy systems such as Marketing Customer Information Files (MCIF) or marketing databases only offer limited rules or associations, such as grouping by address or surname; this restricts banks’ ability to group and segment customers with the granularity they require.

Other challenges associated with legacy systems include:

- Many legacy systems are unable to support automated segmentation at a business level, which requires banks to perform manual grouping.

- Legacy systems are often disconnected from customer-facing systems, which makes it difficult — and, in some cases, impossible — for stakeholders and other important parties to surface account data.

- Certain legacy systems require end users to use a separate application to build their own consolidated views of the customer, which leaves banks prone to human error and vulnerable from a compliance standpoint.

- Legacy systems largely use manual processes, which are slow, inefficient, and provide limited data sets. These manual processes also contribute to slow response times, which can degrade service, increase customer effort, and erode customer loyalty.

For these and a number of other reasons, it’s important that banks invest in modern solutions that offer granular customer segmentation capabilities and the ability to automate essential grouping processes.

How Can You Keep Your Data Clean?

The success of any householding strategy is largely dependent upon good data hygiene. Dirty data — that is, data that is inaccurate, inconsistent, incomplete, duplicate, or outdated — can slow down even the most innovative software solution, so it’s important that banks clean up their data before entering it into new systems. A few best practices for good data hygiene:

- Comb through existing data sets to identify and eliminate duplicate entries.

- Create a standardized process for data entry so that all entries are uniform.

- Develop a consistent schedule for reviewing and updating customer records to ensure data accuracy.

- Automate the data cleansing process to increase efficiency and reduce the risk of human error.

- Break down departmental silos to reduce the likelihood of duplicate data entries across business units.

- Regularly back up data and develop a strong disaster recovery strategy to prevent data loss in the event of an emergency.

How Can Hitachi Solutions Help with Householding?

From automating different householding processes, such as grouping accounts and sub-accounts and reporting, to engaging in fuzzy matching and other analytical work, Hitachi Solutions offers a wide variety of services you help any bank achieve their householding needs. We also offer our very own banking industry IP built on the Microsoft platform that includes built-in householding capabilities. To learn more about Engage for Banking and what Hitachi Solutions can do for you, contact us today.