Digital Transformation Playbook

Is your business ready to reimagine how it operates?

Download the EbookDigital transformation is a term you’ve likely already encountered. It has transformed countless commercial industries – from manufacturing and retail to hospitality and healthcare. The insurance industry has traditionally been slow to modernize, but it is now clearer than ever that the time is now for insurers to embrace digital transformation.

Insurers today have had to digitize various aspects of their operations to keep up with the demands of insureds. Any business that wishes to stay competitive in today’s marketplace must meet customers where and when they need something. The digital transformation of insurance – powered by artificial intelligence, machine learning, predictive analytics, mobile service, live chat, etc. – is enabling insurers to do just that, and will keep changing the industry for years to come.

How Digital Transformation is Changing the Insurance Industry

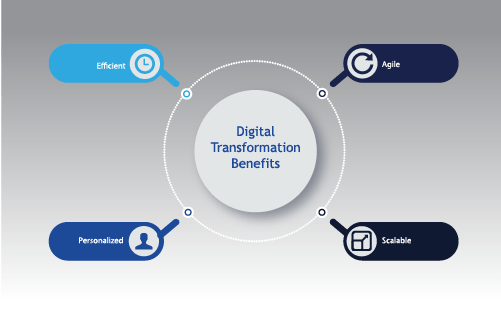

There are countless examples of how digital transformation of insurance has changed the industry. Operations are streamlined, customer interactions are done via chat, claims can be processed automatically, and brokers can aggregate all their information to work faster and more accurately. But the real impact of digital transformation on insurance can be summarized in four benefits:

- Efficient – The first and most obvious effect of digital transformation on insurance is the efficiencies it enables. Primarily powered by AI and its related technologies of machine learning and predictive analytics, almost every facet of insurance operations have been optimized for speed. Claims can be processed via an app instantly, and policy writing can be done in less time with machine learning capabilities. Digital transformation is also speeding up customer service, where live chat and digital assistants are helping customers in their most important times of need.

- Personalized – Customers today expect service and attention where and when they want it. They also expect it to be suited to their needs, and personalization is now the status quo across all industries. Digital transformation is empowering insurers with the tools they need to give customers excellent service without overextending their resources. AI and machine learning create a seamless personalized experience for customers and brokers alike. Customers can pay bills, view policies, and file claims via an app, and brokers can receive and process all information on their end under one system. No more waiting on the phone, wondering if your claim is received and being processed; digital technologies are giving customers instant feedback and helping brokers do their jobs more efficiently and effectively. Digital transformation in insurance is also helping to personalize marketing efforts. Robust data analytics and AI systems can tailor and target marketing efforts for insurers, using the power of social media to reach audiences they can truly impact.

- Scalable – The digital transformation of the insurance industry is also helping it to become more nimble and scalable at both the front end and back end of operations. While insurance historically could be a bit “clunky,” technology today has made it flexible to current demands. On the customer-facing front, insurers today offer service everywhere and anywhere via self-service dashboards and apps and can collect valuable data from customers via IoT-enabled devices and even wearables. On the back end, this technology is collected and helps brokers and insurers make more accurate decisions on underwriting, policies, new product offerings, and more.

- Agile – Digital transformation is also helping insurers “future-proof,” as these technologies will undoubtedly continue to evolve and create more advanced opportunities for years to come. The foundation that is being laid by AI, machine learning, blockchain data, data analytics, and predictive analytics will help insurers grow and adjust with new insurance technologies and capabilities.

These technologies are just the tip of the iceberg for the insurance industry. To be prepared for a digital future, insurers today must adopt the tools of digital transformation and find creative ways to optimize all areas of their operations. In fact, 90% of insurance executives today state they have a coherent, long-term plan for technology innovation in place.

The digital transformation of insurance operations is reshaping the current and future state of the industry. At Hitachi Solutions, we build sophisticated, customized insurance platforms powered by the intelligence of AI, ML, and predictive analytics. Our digital solutions help insurers create the features, functionalities, and applications they need to stay competitive in this market. If you would like to learn more about how Hitachi Solutions can help with your customer insurance solutions, please reach out to our team.