Power Platform is Microsoft’s suite of low code/no-code tools for application development, workflow automation, reporting, analysis, and chatbot functionality.

Power Platform is especially useful for financial services firms. Banks and other firms grow through acquisition, and many of the organizations that these institutions acquire come with legacy systems. Additionally, financial services professionals require the ability to access multiple different data sources with as few clicks as possible in order to monitor financial markets and conduct research. Power Platform enables these professionals to quickly build applications to replace manual processes and integrate over 1,000 systems.

In short, the Power Platform presents financial services firms with the opportunity to simplify the user experience by taking common user functions and making them more streamlined.

12 Ways to Use the Power Platform

There a number of ways that financial services firms can use the Power Platform to make their employees’ lives easier:

- Meeting Notes

It’s essential that financial services firms be able to capture complete meeting notes after meeting with important clients. D365 CE users can already do this using either the D365 desktop or mobile app, however, for busy users on the go, navigating the full D365 app can be time-consuming and challenging.

Banks and other firms can use Power Apps to create a simple app that shows users which meetings they’re involved in and enables them to capture meeting notes and create follow-up actions, all within a single screen. Since Power Apps can also work with other applications, such as the Outlook Calendar, it’s possible to surface additional information within a Power App. This is a great example of how the Power Platform presents firms with simpler, more focused user experiences. - Meeting Tear Sheets

Hitachi Solutions’ Engage for Financial Services solutions provides tear sheet reports, which give equity partners and financial advisors a concise summary of a company’s background and meeting attendees. This is an excellent example of a user scenario that can be delivered as a Power App: Although it’s possible to access these tear sheet reports through D365, a Power App built specifically for tear sheets is an easy way to present users with information about upcoming meetings without having to go through the full D365 application. - Global Contact Management

Financial services firms have traditionally held a very account-centric view of the world — that is, they tend to see clients as accounts rather than individuals, and act accordingly. This mindset is outdated and ill-suited to the realities of digital banking, which prizes a customer-centric approach.

Power Apps helps firms shift to this customer-centric model by enabling them to build apps that can connect to over 300 different data sources, including Dynamics 365 Customer Insights, to gain a 360-degree view of the customer. Armed with this data — including household information, service history, products owned, major milestones, and customer preferences — firms can focus on the individual and deliver personalized marketing, customer service, and more to enhance the customer experience. - Manual Process Automation

Despite the proliferation of modern technology, a surprising number of financial services firms still require their clients to fill out paperwork by hand and rely on manual processes, such as Excel sheets, for data entry and management.

In order to save time and effort, firms can use Power Apps to create digital forms that clients can fill out via iPad or another mobile device. Once a client has filled out a form, Power Automate can automatically upload this data to a centralized database, where it can be securely stored, accessed, and updated as needed. This enables firms to eliminate clunky legacy systems — for example, one of Hitachi Solutions’ clients recently replaced its paper-based financial preferences system and customer profile form with a PowerApp. Using this app, the client is able to repeatedly go back to their live data and update it any time a customer indicates a change in preference. - Fraud Detection

The rise of mobile and remote check deposits has led to an increase in fraudulent activities for many banks and credit unions. The Power Platform can be leveraged to automate fraud detection processes using Power Automate. While images of checks are encrypted and can only be opened through a specific application on a computer, Power Automate desktop enables the image of the deposited check to be opened, have the routing number read and checked against databases of known offenders to help reduce fraud through an automated process to alleviate some manual burden for fraud teams. - Streamlined Onboarding

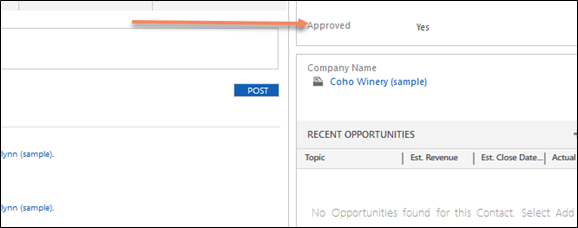

There are a couple different ways financial services firms can use the Power Platform to streamline onboarding; the first is for new customer or member onboarding. As previously mentioned, firms can use Power Apps to create digital forms that customers can fill out electronically with basic information such as their name, date of birth, address, contact information, general preferences, and so on. Power Automate can then upload that information to a centralized database and automatically start to build out a customer profile based on the details provided.

Second, banks and other firms can use Power Automate to simultaneously update information across multiple systems. A firm can make it so that any time Power Automate uploads new customer information to its core customer relationship management system, that data is also pushed to other solutions within its software ecosystem and customer data records are automatically updated. - Business Process Automation & Management

There are many manual processes that take place at a financial services firm. For example, a bank teller might talk to a customer who’s interested in a mortgage and then have to manually route that information to a loan originator. From there, the loan originator would have to use one system to originate the loan application, and then another to track that application as it is processed. Financial institutions can use Power Automate to automatically track this process and a Power App to build an interface to view progress updates, thereby enabling them to manage everything from a single system and save time and clicks. - Remote and Hybrid Work Empowerment

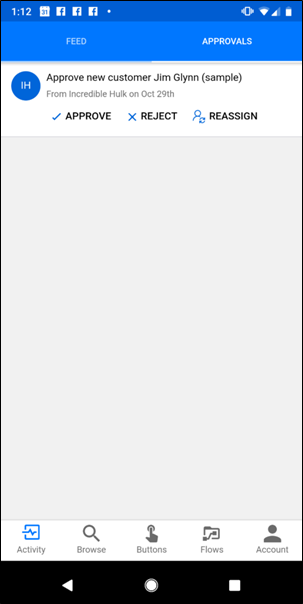

Mobile banking has been an essential service for banks and other firms for some time now but, thanks to Power Platform, financial institutions can now extend that mobility to their employees, as well. Firms can use Power Apps to create mobile apps and experiences that enable financial advisors and other employees to securely support their clients even when they aren’t in the main office.

As mentioned, Power Automate has also enabled firms to replace manual processes, such as approval (more on that in just a moment), with automated processes, which enables employees to collaborate in real time without the need for face-to-face interaction. This functionality has proven especially useful as financial institutions embrace remote and hybrid work. - Customer and Member Engagement Modernization

There are a number of different ways financial services firms can use Power Platform to modernize the customer and member engagement experience, starting with Power Virtual Agents. Power Virtual Agents makes it easy for financial institutions to create artificially intelligent chatbots that can integrate with any number of services, from their online banking platform to their mobile banking solution. Power Virtual Agents is based on the Microsoft Bot Framework but uses a visual designer so citizen developers can easily build chatbots, too; these chatbots can also authenticate users and route customer support issues to a live agent using Omnichannel for Customer Service. - Customer Portals

Using Power Apps, banks and other firms can build easy-to-use portals that enable customers and members to submit requests, securely look up account information, and so on. Although Power Apps portals, Power Pages, are unlikely to replace online banking platforms, they’re ideal for lower-level use cases, such as asking questions or submitting customer support tickets. - Internal Collaboration

Every financial services firm consists of multiple different departments, such as loan servicing, retail banking, risk management, IT, and so on. These departments are typically very siloed but Power Platform and CDS can break down these walls by providing a common underlying data platform while still giving each group the unique experience it needs. - Multi-stage Approval Automation

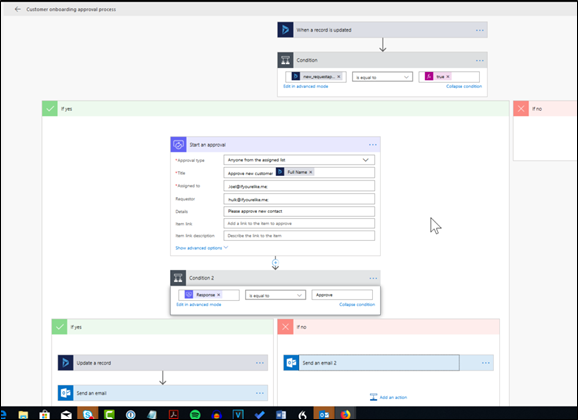

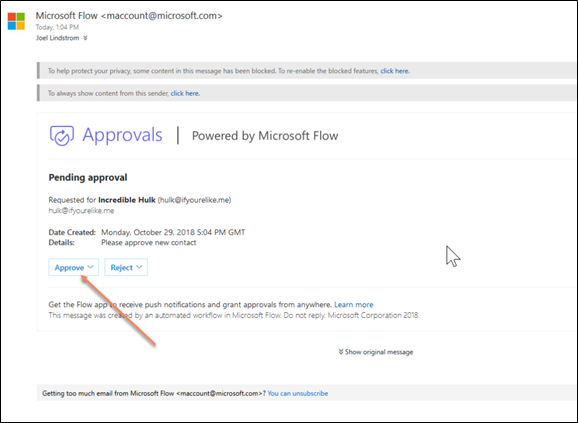

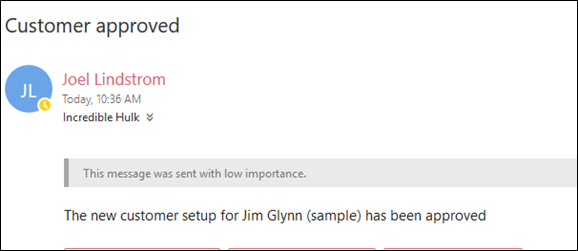

Power Automate offers a robust, elegant, and automated approval process. For example, let’s say that a financial services firm’s new client onboarding process requires legal approval. Using Power Automate, the firm could configure an approval process that automatically triggers any time someone submits an approval request in Dynamics.

The Power Platform in Action

To see the Power Platform’s financial services in action, look no further than the work Hitachi Solutions did with one D.C.-based credit union. This credit union stored data in multiple core systems, which made it very hard to get a complete customer view. It also had no process for routing issues and opportunities to different departments. These challenges had a negative effect on the customer experience and made it difficult for tellers and other employees to do their jobs.

To resolve these issues, Hitachi Solutions used Power Apps to deploy a canvas app that provides tellers across different branches with a simple user interface for interacting with customers. This app enables tellers to quickly locate the customer’s account, validate the owner or joint ownership, and access common teller interaction tasks. The canvas app also replaced a manual paper-based survey that the credit union would use to gather details about a prospective customer’s financial needs and objectives.

As a result of using the Power Platform, the credit union now enjoys the following benefits:

- Superior customer service via streamlined branch interactions

- More empowered employees

- Comprehensive capture of member data to enable predictive analytics

- More efficient routing of cases and opportunities and fewer missed requests

- Faster response time to prospective customers via integrated “Contact Us” forms

- More efficient routing of incoming calls and emails to department queues

Welcome to the Power Platform

These are just a few examples of how the Power Platform extends Microsoft Dynamics 365 for financial services firms. In an industry in which users are busy and customer data is your lifeblood, the combination of D365, Power Apps, and Power Automate can provide a simplified user experience, reduced complexity, increased user adoption, a higher ROI, and more. Best of all, these tools are all included in your standard D365 licensing, which means you can take advantage of the Power Platform today.

Want to learn more? Check out our Power Platform Discovery offer, Enterprise Maturity Engagement, or reach out to us today to start a conversation about how Hitachi Solutions can help your institution utilize the Power Platform.