The Time is Now: Digital Transformation in Financial Services

A Guide for Digital Leaders Looking to Implement Change.

Download the Ebook“Digital transformation” remains one of the biggest buzzwords in the financial services industry. Some banking executives conflate digital transformation with simply investing in digital solutions. Although that’s certainly part of it, it doesn’t really account for the rich tapestry that is digital transformation.

You see, digital transformation in banking isn’t just about technology — it’s also about people, processes, culture, and experiences. Think of it this way: Technology is the gateway to digital transformation, but what you do with that technology determines whether you actually achieve it. If you don’t actively cultivate a digital-first attitude amongst your employees and customers, you’ll only get part of the way there.

There’s no time like the present to rethink your strategy for digital transformation in banking, and we’re here to help you get started.

What is Digital Transformation in Banking?

Microsoft defines digital transformation as:

Although this is a relatively broad definition, it’s an effective summation of the idea that digital transformation isn’t just about technology but, rather, what you do with it. In order for your digital transformation in banking strategy to succeed, it must be designed in such a way that it uses technology to engage customers, empower employees, optimize operations, and transform products.

Here at Hitachi Solutions, we believe digital transformation consists of six key components:

- Innovation: Creating a culture that fosters talent and innovation through agile methodology, outstanding user experience, continual feedback, and real-time collaboration.From one-click loans to universal payment systems, the modern banking customer expects innovative, technology-driven product and service offerings, and banks are under increasing pressure to meet that rising expectation. In order to push the envelope of what’s possible, banks must first turn inward and look for opportunities to reimagine and reinvent the way they approach business challenges.When evaluating new solutions, consider the following:o How will this help us reimagine our company culture?

- How will this help us transform our current business model?

- How will this enable us to grow and change for the future?

- Collaboration: Transforming how employees, customers, and trading partners communicate and work together.Your workforce is one of your most valuable assets. An engaged employee is an impactful employee, and employees are more likely to feel engage when they’re set up to succeed and encourage to collaborate.When evaluating new solutions, consider the following:o How will this enable our employees to do their jobs even better?

- How will we train our employees to use this system effectively?

- How will this help our employees to work collaboratively?

- Experience: Designing solutions from the user perspective that are performant and that enable the right capabilities and business functions.Every interaction, from an ATM withdrawal to in-person financial advising, must be primed for the customer’s experience and should engage them in such a way that it strengthens the customer relationship.When evaluating new solutions, consider the following:o Will this make the customer’s life easier?

- Will this help build trust with our customers?

- How will this improve the overall customer experience?

- Infrastructure Modernization: Transitioning from infrastructure to platform, transferring their operational expense and overhead to innovation budget and opportunity.Legacy systems only serve to slow banks down. Rather than continue to depend on outdated technology, banks need to reduce their on-premises footprint and embrace the cloud in order to reduce operational spend, become more agile, and stay current with the latest technological trends.When evaluating new solutions, consider the following:

- How will this help us modernize our current infrastructure?

- How will this help us lower our operational expense?

- How will this enable us to take advantage of the latest technological innovations?

- Operational Excellence: Unifying finance, operations, supply chain, manufacturing, and customer engagement with industry solutions and expertise.The financial services industry is rapidly evolving, with new innovations emerging every day. In order to avoid ceding territory to FinTechs, banks need to leverage the latest advancements to become more agile and build future-proof structures.When evaluating new solutions, consider the following:

- How will this help us streamline existing operations?

- Will this help us eliminate manual processes and procedures?

- How does this resolve common banking industry challenges?

- Consolidated Knowledge & Integration: The collection and analytical enablement of all data and information in an organization, regardless of source system, business function, or structure of data content.Today’s banking customer operates across multiple channels, and expects their bank to do the same. Banks can provide a seamless experience, whether online or in person, by integrating their existing systems and building out helpful knowledge bases for employees and customers alike.When evaluating new solutions, consider the following:

- How will this help us consolidate our data?

- Will this enable us to create self-service opportunities for our customers?

- How will this enable us to provide a consistent customer experience across channels?

Mapping the Digitized Customer Journey

The customer journey is just one of the many things that digitization has disrupted. With major retailers using technology to reduce the customer journey to just a few clicks, many customers are left wondering why their bank can’t do the same.

The good news is, you actually can — and it all starts with mapping the digitized customer journey.

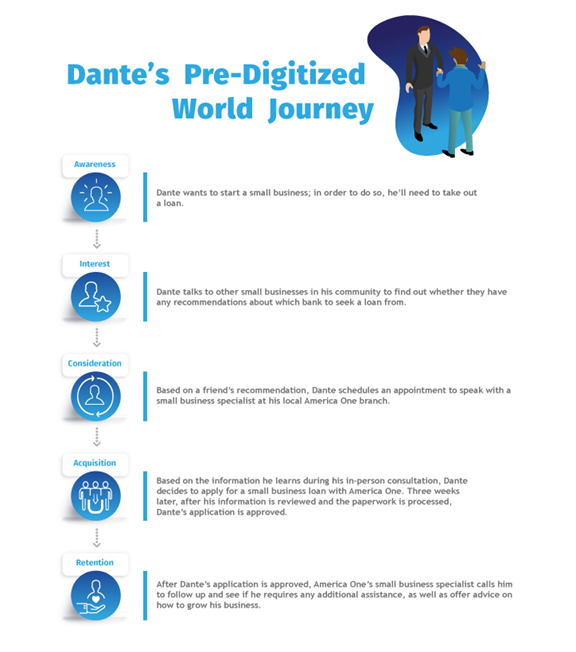

Depending upon who you ask, the average banking customer journey involves between three to six stages. For the sake of this exercise, we’ll look at five: Awareness, Interest, Consideration, Acquisition, and Retention. In the pre-digitized world, this journey might’ve looked something like this:

If any of this looks familiar, that’s because your institution likely took — or perhaps even still takes — a similar approach. This strategy might’ve been effective in the pre-digital era, but it no longer accurately reflects the way customers make banking decisions. Today’s customer operates across multiple channels and expects their bank to do the same. In order to achieve true digital transformation in banking, your customer journey needs to accommodate that expectation.

Based on that, the modern, digitized customer journey might look something like this:

As you can see, the modern customer journey in banking leverages digital components to streamline the process of acquiring products and services, as well as traditional components to strengthen the customer relationship. Taken as a whole, this creates a truly omnichannel customer experience.

If digital transformation is your goal, start by mapping your existing customer journey and looking for opportunities to optimize it using digital solutions. For example, that might mean investing in intelligent chatbots to make customer service and support faster and more efficient or enabling customers to activate new checking or savings accounts from their smartphones using biometrics-based authentication. What’s important is that, in your effort to optimize, you don’t lose sight of one of the core tenets of digital transformation in banking: That technology can do a world of good but, in order to be effective, it must be supported by people and processes.

How to Achieve Digital Transformation in Banking

Once you’ve successfully mapped your customer journey and identified opportunities to incorporate a digital-first approach, the next step is to invest in a single, integrated platform. Many banks use multiple, disparate systems within their organization, which can lead to a litany of issues, including poor data hygiene, regulatory non-compliance, and poor decision-making. Proper data governance is essential to your bank’s success and is dependent upon master data management.

If your institution currently uses multiple systems to collect and store data, consolidating to a single database will take some work. It might even require you to restructure departments or to manually comb through existing databases to weed out duplicate data and other inaccuracies. The good news is that this will all pay off in the form of great collaboration, more accurate data-driven insights, and increased customer satisfaction.

(Here’s a helpful tip: Don’t try to do everything at once. Simultaneously integrating multiple systems is a hefty undertaking and can strain company resources. Start small and scale up as needed.)

In addition to integrating systems within a single platform, you’ll also have to redefine your current operating model. Although this might sound extreme, it doesn’t necessarily mean ripping your current operating model down to the studs and rebuilding from there; instead, it’s about taking a creative approach to optimizing business operations.

The modern banking customer wants an omnichannel experience, one that combines the convenience of a digital approach with the human touch of a traditional one. Redefining your operating model means restructuring your organization in such a way that it accommodates this balance; that might mean creating a new business unit dedicated to digital projects or creating an entirely new digital banking division of your institution with its own dedicated technology. You could even utilize a few different operating models; it all depends on what makes the most sense for your institution.

The final step to achieving digital transformation in banking is to build a strong digital culture. According to report from Gartner, a change-resistant culture is the number one barrier to digital innovation, so it’s vital that you redefine your existing culture so that it can serve as a solid foundation for your digital transformation strategy.

According to Martin Talks, Digital Culture Expert and founder of Matomico, there are eight basic steps to building a digital culture:

- Define Your Organization’s Digital Values: One of the hallmarks of a digital culture is an emphasis on collaboration and connectivity; your bank’s core values should reflect that.

- Assess Where You Are Now: Understanding where you are now will give you a clear idea of where you need to go and make it easier to outline next steps to achieve your goals.

- Tool Up With Technology: Invest in solutions that enable you to meet the core tenets of digital transformation in banking — engage customers, empower employees, optimize operations, and transform products — as outlined above.

- Perfect Your Processes: Redefine existing processes with a focus on agility, scalability, inclusivity, and, above all, data analytics.

- Enable Your People: Invest in formal training and continuous learning so that all of your employees, from bank tellers to customer support specialists, can use new systems with confidence.

- Know That It’s Not All About Digital: Avoid employee burnout by creating a welcoming work environment and enabling them to maintain a healthy work/life balance.

- Develop Your Leaders for the Digital Age: Make sure that your leadership embraces the digital values outlined in step one so that they set a positive example for all others within your institution.

- Ensure Your Organization is Aligned: Place culture at the heart of all of your digital initiatives for a more connected experience.

By following each of these steps — mapping the digitized customer journey, investing in an integrated platform, redefining your operating model, and building a digital culture — you can reap the rewards of digital transformation.

Transform Your Institution with Hitachi Solutions

To reiterate: Digital transformation in banking isn’t just about solutions, it’s also about people, processes, culture, and experiences. By embracing these core tenets of digital transformation in banking, you’ll be able to build stronger customer relationships, adapt to changing consumer demands and market trends, and leverage the latest innovation today to prepare for the financial services industry of tomorrow.

If you need help crafting a custom digital transformation strategy, look no further than Hitachi Solutions. We’ve been working to help organizations achieve enterprise digital transformation through the power of the Microsoft platform for over a decade, and our extensive experience working with clients in the financial services industry make us uniquely qualified to help you take on any challenge. To learn about Hitachi Solutions’ approach to digital transformation, contact us to start your own digital transformation journey.