Our Konsei Culture of Diversity and Inclusion

Culture of diversity and inclusion is growing at Hitachi Solutions and includes new employee resource groups to increase awareness, create a more equitable environment, and build a more diverse workforce

Read the BlogAre you a United States-based IT manager, engineer, or operator of a Japanese-owned company? At Hitachi Solutions, a global systems integrator with leading capabilities in Microsoft solutions and technologies, we have all three. This gives us unique insights into cultural differences that may create a sense of discomfort when communicating with IT departments at Japanese headquarters. In this article, I’m going to share my experiences about these differences and show you how to navigate the culture gap.

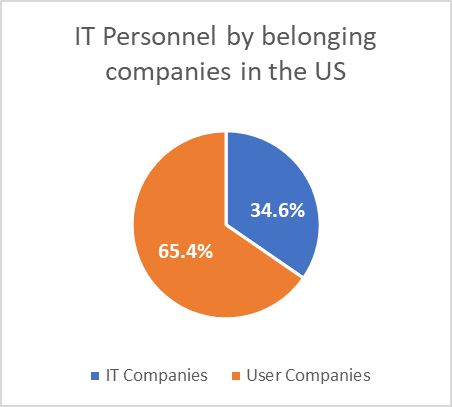

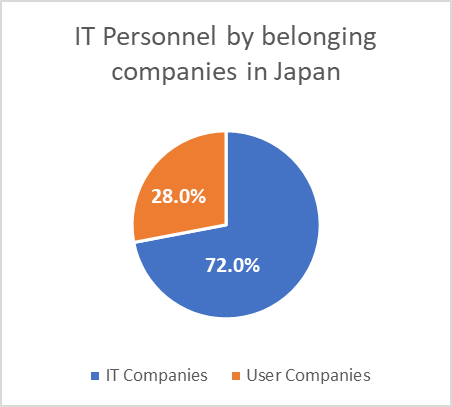

Distribution of IT personnel in the US and Japan

First, I would like to introduce the difference in the distribution of IT personnel between Japan and the United States. According to this white paper from the Ministry of Internal Affairs and Communications of Japan:

- In the United States, 65% of IT personnel belong to user companies and 35% belong to IT companies.

- On the other hand, in Japan, 28% of IT personnel belong to user companies and 72% belong to IT companies.

In Japan, “IT companies” mean companies that provide IT-related services. “User companies” mean companies that have main businesses other than IT-related services and include manufacturing, finance, retail, healthcare, and non-IT service companies. Whereas US companies build most of their information systems in their IT departments and rely on external IT consultants only when they need expertise, Japanese companies do most of the IT-related work (planning, design, development, and operation) by depending on IT companies. These IT companies are called Systems Integration (SI) vendors.

History of IT projects in Japan

The industry structure was born in Japan in the 1960s and 1970s. At that time, banks implemented online banking systems, and companies implemented enterprise resource planning (ERP) and management information systems (MIS). These systems were becoming huge and complicated. On the other hand, in Japan, information system-related operations were treated as non-core operations (cost centers), so cost control and labor-saving were requested. As a countermeasure for the request, each company separated and made the information system department a subsidiary. The subsidiaries are the foundation of current User SI vendors. At the same time, mainframe manufacturers (Hitachi, Toshiba, NEC, etc.) also entered the information system implementation and operation service business. These companies are called Maker SI vendors. Hitachi Solutions in Japan is a Maker SI vendor.

Even after the 1980s, the trend of splitting the information system department and outsourcing IT functions continued. The comprehensive alliance between IBM and KODAK in 1989 was a big reference model for the momentum of “concentration on the core.” The recession from the bursting bubble in 1992 also drove the trend of cost compression.

Since their birth, SI vendors have survived by learning cutting-edge technologies in advance of customers (user companies), proposing IT roadmaps, and efficiently developing and providing higher quality IT systems. User companies have been optimized to use SI vendors as well. The model of the industry structure is similar to the subcontracting structure of the construction industry. The user company makes a master agreement with an SI vendor (called prime contractor), who is responsible for the completion of the project. The prime contractor splits the workload and awards individual work to subcontracted SI vendors (called subcontractors). As a result, user companies have been freed from the risks of IT projects and the complexity of management, and SI vendors have evolved to provide the IT systems desired by user companies while controlling costs.

IT circumstances specific to the Japanese market

This business structure creates circumstances specific to the Japanese market — one of which is scratch development. In Japan, there are still a lot of projects that use many man-hours to develop scratch systems or customize packaged products to meet user requirements. Reasons for this include:

- Due to the business nature, SI vendors tend to make big proposals with many man-hours.

- Historically, Japanese people have delicate temperaments, attentiveness, and customer-first principles. SI vendors and IT departments try to fulfill all of the users’ requests.

- User companies prioritize their existing business processes over standardization by packaged products due to low employment liquidity.

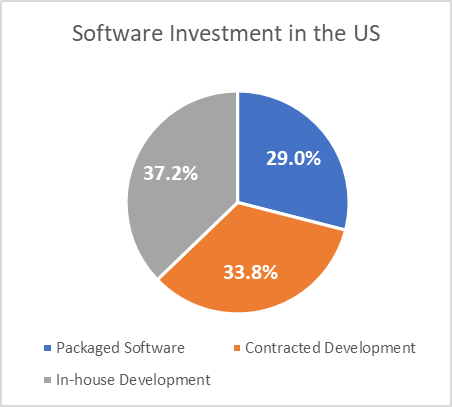

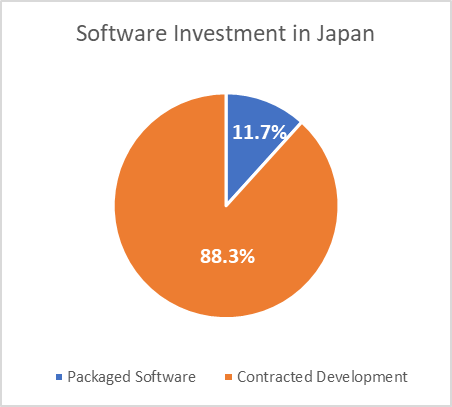

To quote the white paper from the Ministry of Internal Affairs and Communications of Japan again:

- In the United States, the breakdown of software investment is composed of 29.0% for packaged products, 33.8% for contract development, and 37.2% for in-house development.

- In Japan, the ratio of contract developments is 88.3% and 11.7% for packaged products.

Note that the statistics from Japan don’t include in-house development due to the data coming from the SI vendor (supplier) side, but you can see a large ratio of the contracted development. The white paper suggests that such contract development and large-scale customization may not properly utilize the efficient and effective business flows inherent in packaged products.

As for the development method, the waterfall type development method is most often adopted in Japan because it is easy to grasp and manage the milestone and budget, and it is suitable for contract development type projects.

For the future

So far, I have described the history and current snapshots of the Japanese IT market and culture. So what might we experience in the future?

Today, Japanese companies are being forced to reform their business structure through digital transformation (DX) because of international competition. Under such circumstances, it has become a proposition to use IT, which has been treated as a non-core business (cost center), as a differentiating factor for its products and services. User companies that have been strongly dependent on SI vendors have begun to have more in-house IT capabilities. Examples include Fast Retailing, which operates UNIQLO and is the largest apparel company in Japan; Seven and I Holdings, which operates 7-Eleven store chains in Japan and the United States; and MUJI, which operates the MUJI brand worldwide.

The retail industry is easily influenced by consumer trends, so the ability to be responsive to change is required. An increasing number of companies are trying to keep up with consumer expectations by strengthening their IT personnel and in-house IT capabilities. They have found agile and scrum-based development is more suitable for responding quickly to trend changes during the development period, and that it is better to be done in-house.

Also, companies are now starting to use agile development best practices and methodologies. SI vendors also understand the need to be responsive to trends and now provide platform services and technical support to reinforce user companies’ in-house development. There is no doubt that the Japanese IT department, which used to rely on external SI vendors for most of its information systems, will continue to improve its operations, aiming to more closely align with US-style IT management.

As mentioned at the beginning, the readers of this article are assumed to be United States-based IT managers, engineers, and operators of a Japanese-owned company. I think you may get various questions from your Japanese colleagues. Some may wonder, “Why now,” or “Why don’t you build by yourself?” These questions are more a sign of the underlying desire to catch up with the United States and begin to position Japanese IT teams to be more strategic. Actively sharing information and ongoing discussion will help drive improvement and reform of Japanese-headquartered IT teams.

If you would like to dive deeper into this topic, please reach out to our Hitachi Solutions team. We have consultants who are very familiar with Japanese companies and how to do business with them.