As digital transformations ripple through industries worldwide, the banking sector stands on the brink of a revolution. Artificial intelligence, machine learning, and automation are no longer distant aspirations – they have become essential components of the contemporary banking ecosystem.

With the relentless acceleration of technology and evolving customer expectations, traditional banking structures are increasingly insufficient. In a world of instant gratification, banking customers no longer accept brick-and-mortar branches as their sole point of interaction. Instead, they demand swift, personalized services across multiple channels, accessible at their convenience.

To keep up with this dynamic landscape, banks must transition to omnichannel banking, a comprehensive approach that harmonizes multiple channels into a consistent and engaging customer experience. This article unveils why this transition is crucial for your institution to thrive in today’s competitive landscape, bolster customer satisfaction, and fuel sustainable growth in the 21st-century banking industry.

Omnichannel vs. Multichannel: What’s the Difference?

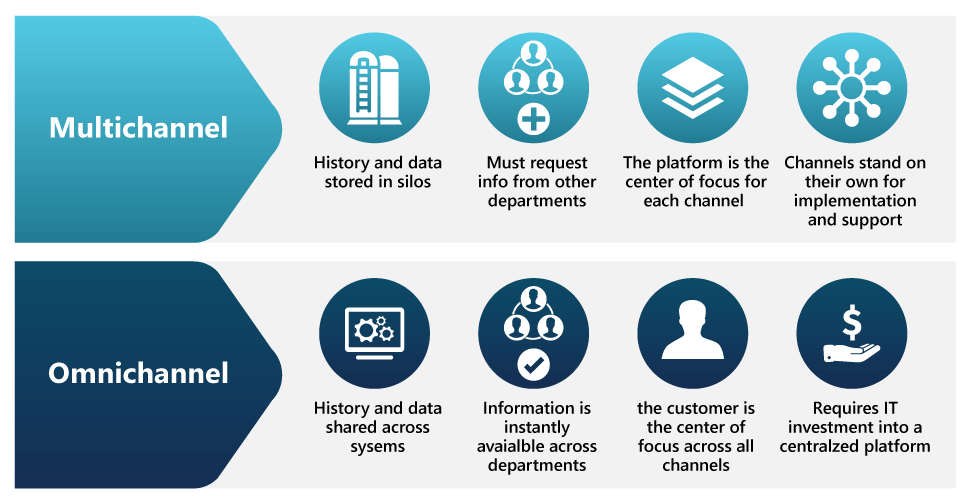

Before we begin, a point of clarification: Though the terms “omnichannel” and “multichannel” both describe approaches to customer engagement and are often used interchangeably, they actually represent different concepts.

Multichannel describes the breadth of customer interactions across multiple touchpoints and channels, including physical branches, websites, mobile applications, social media platforms, call centers, and more. With multichannel engagement, each of these channels operates independently, often relying on its own systems and processes and featuring its own set of services. While customers have a wide variety of options and opportunities for engagement, these channels may not be integrated, leading to a lack of consistency across touchpoints and a disjointed customer experience.

Omnichannel operates on the same basic principle as multichannel — multiple touchpoints across multiple channels — and improves upon it by taking a unified approach. Omnichannel engagement focuses on seamlessly integrating all channels to create a cohesive customer experience. With this approach, customers can initiate an interaction — such as a transaction or a support request — through one channel and effortlessly continue it on another without any disruption to their experience, delivering the consistency and continuity they expect.

What Is Omnichannel Banking?

Omnichannel banking applies the general concept of omnichannel engagement to retail banking by providing a seamless and consistent experience to customers across physical and digital channels, including branch locations, online banking platforms, mobile apps, and contact centers.

In an omnichannel banking environment, customers can initiate a transaction or inquiry through one channel and continue it on another without any disruption. For example, a customer might begin a loan application through a bank’s mobile app, seek further assistance from a live representative through that bank’s contact center, and finalize their loan by signing documents at their local branch. All of the stages in this process are tightly integrated on both the front and back end, allowing for a seamless flow of information, high degree of coordination, and frictionless experience for the customer.

Omnichannel banking not only provides a unified experience to customers — it also allows for a greater degree of personalization by leveraging data and insights from various channels to deliver targeted offers, personalized recommendations, and proactive communication.

This approach to banking gives institutions the opportunity to not only meet but exceed expectations by providing the digital experiences customers demand while still offering a personal touch. Ultimately, omnichannel banking solutions empower retail banks to strengthen their customer relationships, leading to higher satisfaction and long-term loyalty.

A Data-Driven Case for Omnichannel Banking

It’s one thing to claim that customer expectations have heightened, driving demand for seamless experiences that span physical and digital channels, but data tells the real story. Research from McKinsey shows that roughly 60% of banking customers now use digital channels; in fact, 80% of all customer touchpoints and 25% of sales now take place on digital channels.

Despite this demand for digital experiences, banking customers still value face-to-face interactions and a personal touch. According to that same McKinsey report, customers are still reluctant to transact through digital channels for certain products, such as mortgages and investments. In cases such as these, customers rely on live support from experienced professionals to navigate complex processes and make sound financial decisions.

The truth is, there will always be a need for live support, whether in-person or over the phone. A 2022 survey from BAI confirms this, stating that, by 2024, consumers expect 61% of their banking business to be digital and 39% to require human assistance. To strike the right balance between digital self-service and in-person interaction, retail banks must leverage omnichannel banking solutions to tightly integrate various touchpoints and channels.

Doing so not only enables banks to design frictionless customer journeys but also empowers them to collect, process, and analyze customer data to unlock valuable insights. Capgemini reports that 75% of customers surveyed have had their digital banking expectations heightened by FinTechs, but that 70% of banking executives say they lack the data analysis capabilities to deliver highly personalized omnichannel banking experiences.

If there’s one thing that’s clear, it’s that retail banks need to invest in omnichannel banking solutions to keep pace with change, delight their customers, and drive sales — and the sooner, the better.

7 Ways Banks Stand to Gain from Omnichannel Banking

For retail banks that require further incentive to enter the world of omnichannel banking, here are just a few of the ways they can benefit:

Data Analysis

Many omnichannel banking solutions have data collection and analysis capabilities. Since omnichannel banking is unified by design, banks have the ability to pull data from a wide variety of sources and create a unified customer view. By applying analytics — including predictive analytics — to customer data, banks can better understand and even anticipate customer needs and provide proactive service across channels.

Not only that, but banks can also leverage omnichannel banking solutions’ built-in analytics tools to monitor customer behavior, identify potential upselling and cross-selling opportunities, develop new products, and respond to changes in the marketplace in a timely manner.

Customer Segmentation

With a wealth of customer data at their disposal, retail banks can build detailed customer profiles and segment customers based on demographic data, past behavior, and even preferences across various channels. Customer segmentation enables banks to tailor their marketing efforts, product offerings, and individual experience to specific segments. By delivering personalized and targeted solutions that resonate with each group, banks can increase customer engagement, improve satisfaction, and drive revenue.

Real-time Engagement

Omnichannel banking delivers a continuous flow of real-time data to retail banks, which they can use to monitor customer interactions, individual preferences, and behaviors across various channels. Whether it’s through personalized notifications, instant messaging, or interactive chatbots, omnichannel banking facilitates immediate and relevant communication with customers.

This real-time engagement also enables institutions to proactively address customer inquiries, resolve issues, and deliver personalized recommendations, fostering a seamless and responsive customer experience that meets the expectations of today’s digitally connected customers.

Value-added Services

By tapping into customer insights, retail banks gain a stronger understanding of their customers’ needs and preferences, which they can use to develop new products and services that solve specific pain points. Banks can also leverage insights derived from omnichannel banking to create value-added services, such as financial advising, loyalty programs, financial education workshops, budgeting tools, and digital payment solutions.

When combined with other innovative technology, such as low-code development, omnichannel banking solutions empower banks to bring new products to market at faster speeds, creating new revenue-generating opportunities.

Fraud Detection

By tightly integrating various touchpoints and channels, retail banks can more easily monitor, detect, and respond to fraud across channels. And, by leveraging data analytics, banks can analyze customers’ behavior patterns and identify anomalies, such as unusually large purchases or login attempts from unfamiliar IP addresses. These data-driven insights, made possible through omnichannel banking, enable institutions to proactively respond to perceived threats and prevent fraud from jeopardizing their customers or their business.

24/7 Service

The more channels customers interact with, the more places where retail banks need to be ready to provide support — something that’s often easier said than done, especially given staffing shortages at contact centers across the country. The good news is that many omnichannel banking solutions can integrate directly with chatbot and virtual agent platforms, enabling institutions to provide round-the-clock service across all channels and free up live agents to focus on higher-priority tasks.

Better still, certain virtual agent platforms utilize cutting-edge technology, including conversational AI, machine learning, and natural language processing to deliver personalized responses and recommendations using natural-sounding language. Compared to traditional chatbots — and all their limitations — these artificially intelligent virtual agents are able to provide more targeted answers to customer inquiries, resulting in a better overall experience.

Don’t Miss This Special Offer: Conversational AI Quickstart

Minimize repeated tasks for your team and provide easy self-service for customers.

Get the offerEmployee Empowerment

Customers and bank leadership aren’t the only ones who reap the rewards of omnichannel banking — employees across all teams and departments benefit, too. By gaining a unified view of customer interactions and building out detailed customer profiles, bank employees can easily access relevant information, regardless of which channel the customer used. This reduces the amount of time employees need to spend tracking down specific information, as well as eliminates redundant data entries, and lowers the risk of human error.

When combined with other technologies, such as business process automation, omnichannel banking solutions can free up employees to focus on value-adding work, rather than tedious, manual tasks. This allows for better resource utilization, as banks can deploy employees based on real-time demand across channels. Finally, omnichannel banking facilitates inter-team and cross-team collaboration, enabling bank employees to share information in real time and work together to make data-driven decisions.

6 Things to Keep in Mind When Implementing Omnichannel Banking

For any retail banks looking to make the switch to an omnichannel digital banking platform, there are a few things to know before getting started. Banks should be mindful of the following:

Legacy Systems

Many retail banks rely on legacy systems that are incompatible with modern technology, making it difficult — if not impossible — to integrate new digital tools and services. Without these integrations, banks cannot realize the full potential of omnichannel banking, so it’s important that they modernize their infrastructure to allow for seamless integration.

Data & Organizational Silos

Retail banks often have data and organizational silos that make it difficult to share data across departments and systems, which can hinder data analytics and real-time decision-making. Though omnichannel banking can help break down and create a unified view of customers across channels, institutions need to cleanse data to avoid any redundancies, inconsistencies, or inaccuracies caused by these silos.

Cybersecurity Threats

The banking industry is a prime target for cyberattacks, which can compromise customer data and damage a bank’s reputation. For all its benefits, omnichannel banking can introduce new areas of risk, including unauthorized access across various channels, phishing attacks targeting multiple touchpoints, and the need to ensure consistent security measures across different platforms and devices.

To combat these risks, retail banks should look to implement robust cybersecurity measures across all channels, such as encryption, multi-factor authentication, and real-time transaction monitoring. They should also prioritize ongoing employee training and awareness programs and conduct regular security audits to ensure that customer data stays out of the wrong hands.

Regulatory Compliance

The banking industry is heavily regulated, with a broad range of laws and regulations that banks must comply with, many of which apply to customer data privacy and security. Adopting new digital tools, including omnichannel banking solutions, can create compliance challenges, which retail banks must carefully navigate to avoid fines, civil penalties, and reputational damage.

Lack of Internal Resources

Omnichannel banking solutions require specialized skills in areas such as data analytics, artificial intelligence, and cybersecurity. Oftentimes, banks lack the internal resources and expertise to support these advanced technologies, and finding and hiring IT talent with these skills can be challenging, particularly in today’s competitive job market. To offset this challenge, retail banks should look to partner with an experienced solution implementer to modernize existing systems and get up and running with omnichannel banking solutions.

Customer Adoption

While omnichannel banking can improve the customer experience, it can take some time to convince customers to use new technologies, let alone time for them to get comfortable with it. Banks can encourage customer adoption by designing new tools and services to be user-friendly, effectively communicating their benefits to customers, and offering educational workshops to help them get familiar with new tools.

Navigating the Future with Hitachi Solutions: Elevate Your Banking Experience

The future of banking is omnichannel, and Hitachi Solutions is your ideal partner in navigating this exciting journey. We offer a broad spectrum of tailored omnichannel banking solutions, leveraging powerful platforms such as Microsoft Dynamics 365, Azure, and the Power Platform, all enriched by our exclusive industry IP.

The key to our prowess lies in our world-class technologies and the people who bring them to life. With Hitachi Solutions, you are gaining a partnership with a team with unrivaled technical expertise and a strong history of successful implementations, aiming to turn your banking vision into reality.

When you choose Hitachi Solutions, you choose a partner committed to helping you exceed customer expectations, bolster operational efficiency, and secure sustainable growth. We understand the unique challenges faced by today’s banks and are ready to assist you in transforming these into opportunities.

Are you ready to embark on your omnichannel banking journey and drive unprecedented growth and customer satisfaction? To learn more about how Hitachi Solutions can power your transition to the future of banking, reach out to us today. We’re not just here to support you — we’re here to propel you forward.

To learn more about how Hitachi Solutions supports omnichannel banking, contact us today.

The Future of Financial Services Is Here – Are You Ready?

Discover how to digitally transform your bank and future-proof your enterprise with the insights found in our guide for business leaders.