Intelligent Customer Experience with Microsoft D365 Customer Insights for Financial Services and Insurance

2 Weeks* | Starting at $30,000 USD

Download the OfferThe retail industry has always been known for its attention to customer experience: From eye-catching in-store displays to customer loyalty rewards programs, retailers have long looked for innovative ways to go above and beyond for their customers. Knowing that they’re at an automatic disadvantage due to the lack of face-to-face interaction, eCommerce retailers have taken this dedication to customer experience a step further, offering seamless checkout, fast shipping, and exceptional customer service.

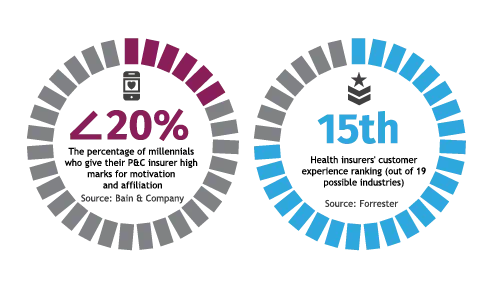

Now, it might seem strange to open an article about the insurance industry by talking about retail, but it’s more relevant than you might think. You see, if there’s one thing the insurance industry has really struggled with, its customer experience. According to a survey from Bain & Company, fewer than 20% of millennials give their property and casualty (P&C) insurance companies high marks for motivation and affiliation, two key components of a quality customer experience. And that’s just P&C insurance — for another example, look no further than health insurance plans, whose customer experience ranks 15th out of 19 industries according to a report from Forrester.

Given the current state of customer experience in the insurance industry, carriers across all sectors can afford to take a page or two out of the retail industry’s playbook. Let’s look at how taking a few pointers from the retail industry can improve the insurance customer experience — and how digitization can take it to the next level.

Collect as Much Customer Data as You Can

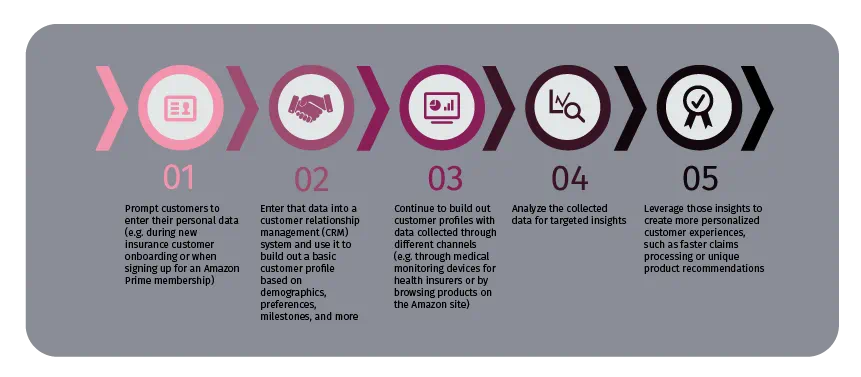

Similar to insurance companies, retailers — especially eCommerce retailers — collect customer data across hundreds, if not thousands, of digital touchpoints. In fact, the basic framework for how a retailer collects, analyzes, and uses customer data isn’t all that different from how a carrier would:

Data collection has always been central to the insurance industry and today, insurance companies need to find creative ways to leverage it in order to develop offers and experiences tailored to the individual policyholder. Much like how retailers provide product recommendations based on a customer’s recent purchases and search history, a carrier could view a policyholder’s profile and see that they were recently married; based on that information, the carrier might target that policyholder with a marketing campaign relevant to that particular milestone, such as for home or auto insurance policies.

To avoid accusations of data appropriation, give policyholders the ability to opt into sharing their data whenever possible, or take things a step further and actively incentivize them to share their data. For example, auto insurance companies such as Progressive have enjoyed great success using optional plug-in telematics devices to collect policyholder data in exchange for policy and premium discounts.

Eliminate Customer Effort Wherever Possible

One of the most important customer service tenets that all retailers, both brick-and-mortar and eCommerce, swear by is to systematically eliminate customer effort. To that end, certain retailers have dedicated themselves to streamlining the traditional customer service experience, with the long-term goal of eliminating it entirely. In fact, one online retailer has gone so far as to remove any contact information from their site; when you click “Help,” you’re redirected to the retailer’s customer knowledge base. We’re not suggesting that insurance carriers start eliminating all contact information from their sites — in fact, doing so would probably result in a negative insurance customer experience. Instead, we recommend that insurance carriers zero in on two key elements of this tenet: self-service and automation.

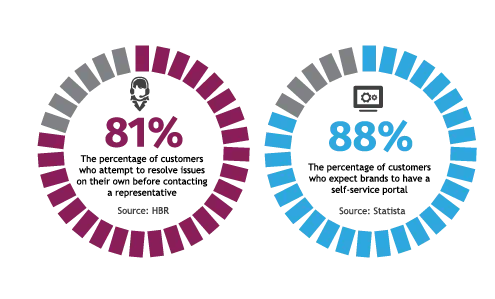

Self-service has become one of the most important insurance customer experience trends today and is rooted in customers’ desire to control where, when, and how they interact with service representatives. Harvard Business Review reports that 81% of all customers attempt to resolve issues on their own before contacting a live service representative — a figure consistent with Statista’s findings that 88% of customers expect brands to have a self-service support portal.

In order to take advantage of this trend, insurance carriers need to turn their websites into full self-service portals that policyholders can use to quickly look up policy information, apply for a new policy, file a claim, and more.

To get a better understanding of how this works, imagine that an auto insurance policyholder files a claim through their insurer’s self-service portal after getting into a fender-bender. Once the policyholder has entered all relevant information, including details about the other driver’s vehicle and photos of the damage, it is automatically sent to the insurer. The insurer processes this information, sending automated notifications to the policyholder or insured on the status of their claim. If there are any issues with the claim, a live service representative will contact the policyholder or insured with follow-up questions. The end result is a claims experience that is fast, efficient, and easy, and that consistently boosts policyholder renewal rates.

As you can see, this system is designed not only to eliminate policyholder effort, but also to eliminate the insurer’s effort. Other benefits to implementing self-service and automation include:

- Reduced call volume in customer service centers

- Reduced customer service costs

- Expedient policy application and claim initiation processes

- Reduction of manual administrative tasks

- Increased agent productivity

- More attentive, personalized customer service

Insurance carriers can even go the extra mile by building a branded mobile application that offers all of the same functionality as their web-based portal, thereby enabling policyholders to access self-service features at any time, from anywhere in the world.

Create a Seamless Customer Journey

We mentioned earlier that retailers collect data across numerous digital touchpoints. It’s important to note that these touchpoints are designed in such a way that, from the customer’s perspective, they never feel separate or disjointed but are, rather, all elements of a cohesive customer journey.

For example, a customer can view an item on a retailer’s website from their desktop computer; later, when using that same retailer’s app on their phone, that customer will see that same item listed under their “Recently Viewed Items.” Or, let’s say a customer adds a product to their cart via a retailer’s app, but doesn’t check out. That customer will later receive an email from the retailer reminding them that they have items in their cart, prompting them to complete the transaction. This type of connected, omnichannel experience is becoming more common amongst retailers, especially in eCommerce; industry-leading retailers ensure that the customer experience across each channel is consistent, thereby contributing to a seamless customer journey.

Insurance customers are already accustomed to operating across multiple channels — now it’s time for carriers to catch up. In order to create a seamless policyholder journey, carriers must consistently provide fast, responsive service, regardless whether the policyholder is using their mobile app, interacting with a live representative, or utilizing any channel in between. Using technology, such as a CRM system, to build a centralized database for policyholder data makes it easy for carriers to gain a 360-degree view into who their customers are, what products they currently have or have used in the past, their service history, the pain points they’re currently experiencing, and so on. With access to this granular information, agents are more empowered to assist policyholders without asking them to reiterate the challenges they’re facing time and time again, leading to a faster resolution and a more positive insurance customer experience.

Don’t Be a Customer Experience Laggard

We’ve learned some valuable lessons today about how to improve the customer experience in the insurance industry by taking a page out of the retail industry’s playbook — now it’s time to put those lessons to good use.

At Hitachi Solutions, our years of insurance industry experience give us a unique appreciation of the mounting pressure providers are under to keep up with rising consumer expectations and stay ahead in an increasingly competitive market. That’s why we specialize in building powerful solutions on the Microsoft platform designed specifically to enable insurance companies to adapt to the digital landscape and to deliver exceptional customer experiences. From Engage for Insurance to our Insurance Sales Insights Dashboards, and from data science to data analytics, we’re here to help you digitally transform your business from the ground up.

Ready to reimagine your current insurance customer experience? Contact our team of specialists to get started.