Recurring revenue — be it monthly or annual — is critical to the overall health of your business. Recurring revenue has become a popular business model because, with a predictable, steady stream of income, you can forecast revenue months in advance, create budgets with a high degree of certainty, prepare for fluctuations in revenue, and sustainably grow your business over time. The greatest threat to recurring revenue for any company is churn.

The Definition of Churn

Churn — also known as customer churn, customer attrition, and customer turnover — is what happens when a customer ceases to use your product or service and terminates their relationship with your company.

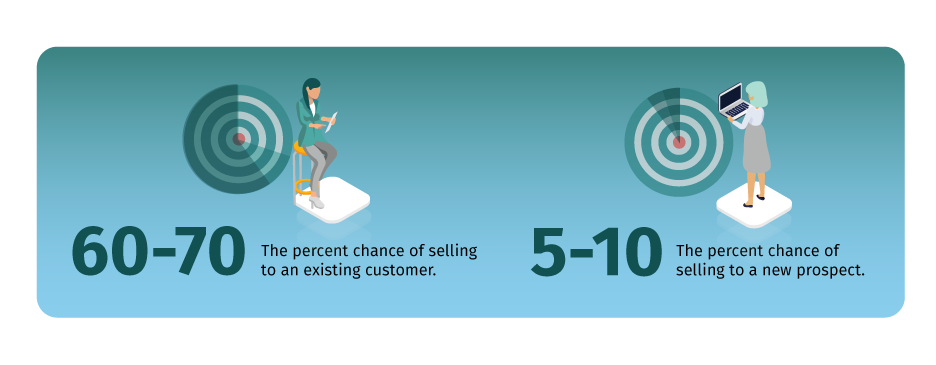

Given that your existing customers are your most profitable — you have a 60%-70% chance of selling to an existing customer, but only a 5%-20% chance of selling to a new prospect — it’s vital to the continued success of your company that you manage and market to them effectively.

Over the course of this blog post, we’ll discuss ways to identify and prevent churn — but first, let’s talk about the different types of churn to be aware of.

Different Types of Churn

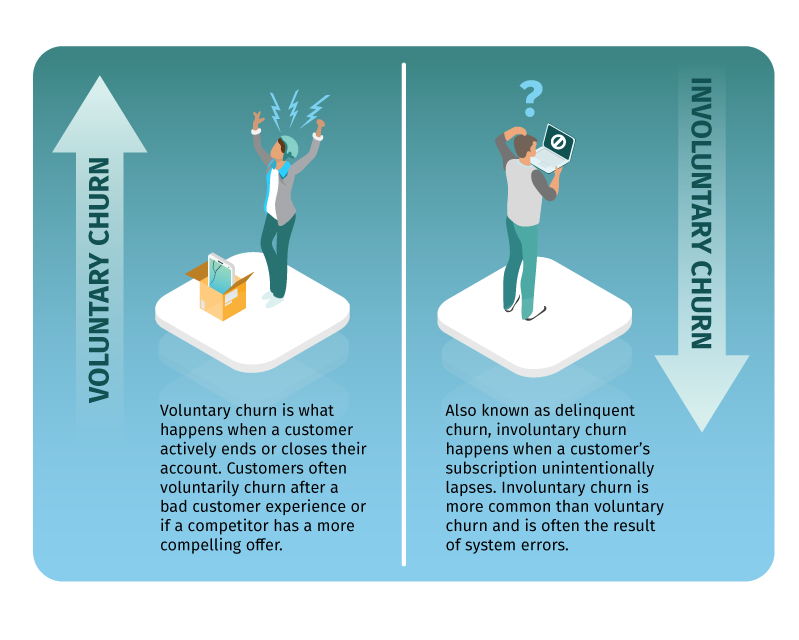

There are two types of customer churn: voluntary and involuntary.

It’s important to understand the differences between these two types of churn because, as you can see, they have very different root causes and, therefore, very different resolutions. Since voluntary churn occurs when a customer actively opts out, resolving it requires a very customer-centric approach — look for opportunities to enhance customer engagement, improve the customer experience, help customers see the value in your product, and so on.

To prevent involuntary churn, send customers reminders when their subscription is about to lapse, or their policy is about to expire, keep customer card information as current as possible, and conduct regular internal reviews to identify and eliminate any potential system errors.

How to Calculate Your Customer Attrition Rate

As cliché as it may seem, the old adage of “You can’t manage what you don’t measure” is absolutely true, especially when it comes to customer churn. Before you can start developing a customer retention strategy and implementing best practices, you first need to know exactly what you’re up against.

You can measure churn by calculating your customer attrition rate, also known as customer churn rate or customer turnover rate. Your customer attrition rate is the percentage of customers or subscribers that discontinue services within a given period of time.

To determine your customer attrition rate, subtract the total number of customers at the end of a given period from the total number of customers at the beginning of that period. Then, divide that sum by the total number of customers at the beginning of the period and multiply by 100.

For example, let’s say you had 225 customers at the beginning of the year and ended with 195 customers. Based on these numbers, your company’s customer attrition rate would be roughly 13%.

There’s really no such thing as a “good” churn rate. In an ideal world, your churn rate could be zero, however, such a rate is unheard of. The fact of the matter is that what constitutes as a “good” customer attrition rate is relative and varies from one industry to the next. For example, according to data from Statista, the average customer churn rate for 2020 was 24% for the retail industry, 25% for financial services, 21% for telecom, and so on. On the whole, B2C companies typically experience a higher rate of customer churn than B2B companies — 7.05% for B2C and 5% for B2B.

How to Predict Customer Churn …

Although there’s no magic crystal ball that can tell you whether a customer is definitively going to churn, there are a few helpful indicators you can look for, including:

- Low engagement and usage: If you notice that a customer is logging into their account less frequently than they normally would or worse — have stopped logging in entirely — that’s a sure sign that they’re at risk of churning. For organizations that don’t monitor account usage, fewer interactions — phone calls, emails, and so on — with a customer can also be a sign that they’re likely to churn.

- Downgraded subscriptions: Similar to low engagement, if a customer downgrades their current subscription to a lower tier, that’s a clear sign that they have less of a need for your product or service and are therefore more likely to churn.

- Account changes: Minor account changes, such as a change in address or billing information, aren’t cause for concern, however, a change in the total number of end-users should spark additional investigation on your end.

- Price point dissatisfaction: The fact of the matter is that customers are never going to be happy about price increases, even if they truly love your product. If you have plans to raise prices in the near future, consider offering your customers extras to create a higher perceived value; this will soften the blow and prevent customers from abandoning ship.

- Poor CSAT And NPS scores: Customer Satisfaction (CSAT) and Net Promotor Scores (NPS) are two leading KPIs used to monitor and measure customer satisfaction. If a customer offers you low scores for either, it’s a strong sign that the customer is unhappy and could churn.

- A high volume of customer complaints: This is, perhaps, the most obvious warning sign of churn. If a customer has multiple complaints on file, it’s safe to assume that they’re at risk of churning. In general, a high volume of complaints is a clear indicator that something is wrong with your product, support, or overall customer experience and should prompt serious introspection.

… And How to Prevent It

In order to fortify churn management and protect your recurring revenue, we recommend implementing some of these churn reduction best practices:

- Make a great first impression. It takes customers just 27 seconds to form an impression of your business, so it’s imperative that you start things off on the right foot. The best way to make a great first impression is to immediately explain to prospects how your solution solves their pain point or challenge.

- Exceed expectations with every interaction. Once you’ve made a positive impression and closed the deal, be sure to consistently deliver on the promises made during the sales process in order to win customers’ trust and long-term business.

- Provide exceptional customer service and support. This one should really go without saying but to illustrate just how essential good customer service is to customer retention, according to one survey, eight in 10 customers say they’d switch to a competitor due to a poor customer service experience. Some basic ways to improve customer service include developing a unified support strategy across all channels, being proactive about service and support, and providing customers with self-service options.

- Develop video tutorials and other educational material. One of the leading reasons customers churn is because they don’t have a clear understanding of how to use the product or solution they’ve purchased. Fortunately, this is a relatively easy problem to remedy — in addition to providing excellent customer support, develop video tutorials and other educational material that will walk customers through how to use your product or service, as well as answer frequently asked questions.

- Optimize the customer experience. When we say “optimize” in this context, what we really mean is that you need to make sure your customer experience is seamless across all channels and really speaks to the individual customer’s wants and needs. The best way to do that is to start by getting to know your customers: What challenges do they face? What goals do they need to meet? What is their purpose for using your solution? You can use this information to map the customer journey across your various channels, identify and proactively resolve problems at each touchpoint along that journey, and tailor each and every interaction to the individual.

- Reward customer loyalty. There are any number of ways to reward customer loyalty, from offering a subscription discount to providing early access to new features and capabilities but developing a loyalty program may just be the most effective. According to the Bond Loyalty Report, 81% of consumers are more likely to continue to do business with brands that offer loyalty programs.

In order to create a loyalty program, consider the following:- What is the objective of your loyalty program? (Is it to increase revenue? To increase the number of word-of-mouth referrals? Something else?)

- What structure will your loyalty program take? (Will it be a points-based, a tier-based system, or something else?)

- How will you reward loyal customers? (For example, you might offer them special discounts or early access to new features and capabilities.)

24 Strategies to Build & Maintain Customer Loyalty >>

- Surprise your customers. A loyalty program is a good start, but another way to reward your best customers is to add a personal touch to every interaction. Something as simple as a handwritten note expressing appreciation for their loyalty can be a lovely surprise and a meaningful incentive for customers to remain with your business.

- Listen to what your customers have to say. At the end of the day, no one knows better about what matters to your customers than your customers, themselves. Whether it’s reviewing customer complaints or soliciting direct feedback via customer satisfaction surveys, go straight to the source to get a clear understanding of what challenges your customers face, what they’re looking for in a solution, and how they feel about your product or service. Armed with this information, you can start to make improvements and build a comprehensive customer retention strategy.

- Follow up with unhappy customers. Again, your customers are your most valuable asset in the fight to reduce churn. Given that a surprisingly low number of unhappy customers actually complain, if a customer goes out of their way to complain rather than just silently churn, it’s a good sign that they aren’t a lost cause — at least, not yet.

It’s important that you treat each complaint you receive with care and take the time to talk over the issue at hand with the customer who filed it. What were they dissatisfied with — was it the product itself, customer service, the customer experience, or something else entirely? How would they have preferred you handle the situation? Going forward, what can you do differently to ensure that this doesn’t happen again? Following up with unhappy customers is a proven way to get directly to the root of customer attrition. - Determine when to take action. We talked about the different ways to identify whether a customer is at risk of churning, but at what point should you intervene? Is it at the first sign of trouble? After a customer has filed a complaint? Somewhere in between?

Unfortunately, there’s no one-size-fits-all answer to that question — it depends on a multitude of factors, including your company’s available resources, your relationship with the customer, and the customer, themselves. Once you’ve carefully weighed these factors and figured out when is the right time to act, make sure you’ve communicated that strategy with your employees so that they know how to appropriately respond to potential churn risk. - Create predictive churn models and run churn analysis. Predictive modeling is a powerful tool for anticipating and preventing potential churn. Predictive churn models leverage historical data and machine learning to identify behavior patterns that could point to possible churn. Once you’ve determined your company’s customer attrition rate and created a predictive churn model, you can run customer churn analysis to reduce churn.

- Know when to let go. As painful as it is to admit, your company or solution won’t be right for every customer, and vice versa. Desperately trying to hold onto every single at-risk customer will require a significant time and financial investment. Depending on what resources you have on hand, that investment might cost your company more than it’s actually worth.

Therefore, it’s in your best interest to figure out which at-risk customers are worth saving. The most practical way to do this is to separate the wheat from the chaff — that is, to separate customers who have been consistently loyal and have evangelized for your company or solution in the past from those who have been fair-weather friends. The greater a customer’s lifetime value, the more valuable they are to your business and the worthier they are of saving. These customers are also more likely to respond to customer retention efforts than others, meaning you’ll see a greater return on investment from trying to convince them not to churn.

Stop Churn in Its Tracks with Hitachi Solutions

If there’s one key takeaway from this article, it’s that the fight against customer churn starts almost always starts with improving the customer experience. Fortunately, at Hitachi Solutions, we offer a wide variety of solutions, services, workshops, and more designed specifically to help enterprise-scale organizations craft exceptional customer experiences.

Get to the heart of why customers churn with data-driven insights; design experiences that increase customer engagement and retention; find out what really matters to your existing customers using powerful analytics solutions built on the Microsoft platform — with Hitachi Solutions, you can do it all.

Contact us today to discover what Hitachi Solutions can do for you.