Microsoft Power Platform for Process Automation for Financial Services and Insurance

2 Weeks* | Starting at $20,000 USD

Download the OfferThe Future of the Insurance Industry: An Outlook

The past few years have upended our collective sense of normalcy, supplanting old ways of living with dramatically new ones and forcing us to adapt to change at an unprecedented pace.

The same is true for the insurance industry. Although the COVID-19 pandemic has had far-ranging impacts for insurers, its most significant — and lasting — effect has been an industry-wide push toward digitization.

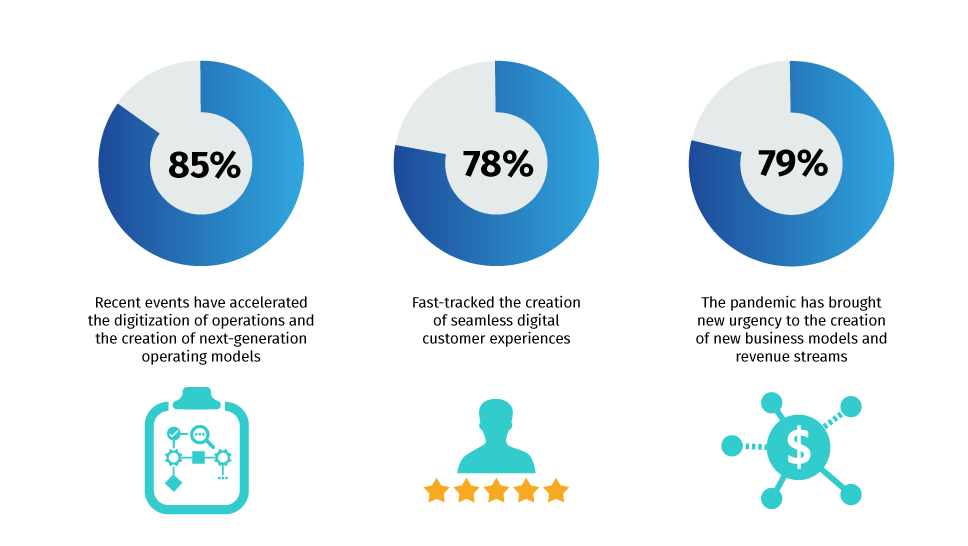

According to a recent industry survey, 85% of insurance CEOs say that recent events have accelerated the digitization of their operations and the creation of next-generation operating models; 78% say that they’ve fast-tracked the creation of seamless digital customer experiences, and 79% say that the pandemic has brought new urgency to the creation of new business models and revenue streams.

When viewed in combination with other major changes in the insurance industry — the automation of essentials workflows, the rise of massive agencies and brokerages due to mergers and acquisitions, the expectation of always-on customer service thanks to mobile technology, and the widespread adoption and usage of data analytics, to name a few — these figures provide a helpful compass for the future.

Join us as we take a closer look at the insurance industry — where it is now, and where it’s headed next.

Existing Challenges Within the Insurance Industry

The rapid push for digitization that we’re seeing in the insurance industry today — and which will shape its future — is a direct response to some of the most pressing pain points insurers face. These challenges include but are not limited to:

- Disparate Systems Threaten Brand Consistency

Mergers and acquisitions within the insurance industry have largely made mom and pop shops a thing of the past, replacing them large legal entities which dominate the scene. Although this consolidation introduces new opportunities for insurers in terms of increased market share, access to new funds and assets, and more competitive standing, it also saddles agencies and brokerages with disparate systems and processes, to the detriment of brand consistency.

- Consistency vs. Customizability

Although standardizing processes and moving all new players onto a single, consolidated platform might seem like the obvious solution to a lack of brand consistency, it isn’t that simple. In order to deliver an excellent customer experience, different offices, agents, and brokers need the flexibility to provide customized offerings based on the region in which they’re located, the division in which they operate, various industry regulations, and the needs of both the customers and industry they serve.

- More Data Means More Complexity

Data has become one of the most valuable assets for insurers, enabling carriers to develop new products and policies based on market demand, agents and brokers to uncover sales opportunities, and underwriters to more accurately assess risk. With that said, the sheer volume of data that insurers collect can be overwhelming, and mergers and acquisitions put additional strain on already overtaxed systems.

In order to ensure that agents and brokers have access to the tools and information they need to do their jobs, insurers must invest in technology capable of ingesting information from hundreds of thousands of different data points, both internal and external, and accommodating hundreds of different processes across multiple channels, all without sacrificing performance or consistency.

Evolving into the Agency of the Future

In order to overcome these various challenges and capitalize on the wealth of opportunity that exists within the insurance industry, agencies must evolve into the agency of the future.

The agency of the future is a massive organization made up of dozens — even hundreds — of subsidiary companies brought together through mergers and acquisitions. Despite the many business divisions within it and the multiple carriers whose products and policies it sells, the agency of the future operates with incredible efficiency and agility, offering consistency and customization in equal measure.

The agency of the future also:

Empowers Agents & Brokers

Though selling new policies may be their top priority, most insurance agents and brokers have a wide range of responsibilities. They’re generally expected to:

- Provide excellent customer service and support

- Maintain an encyclopedic knowledge of available offerings Promote new products, policies, and packages as they come to market

- Promote new products, policies, and packages as they come to market

- Have access to the most up-to-date information on policyholders, claims, policies, and more

- Help facilitate the claims process between policyholders and carriers

- Facilitate policy renewals, amendments, and other policy changes

- Stay on top of license renewals

Given how much they have to balance, it can be challenging for agents and brokers to stay on top of everything — and understandably so. If agents or brokers feel unsupported or as though they’re struggling to manage their various responsibilities, it can damage customer relationships and take a toll on their job satisfaction.

To prevent this from happening, the agency of the future equips internal teams at local offices with a comprehensive technology platform to keep agents and brokers empowered and informed. It also motivates teams to take more control over their book of business, such as running campaigns, making data driven sales decisions and personalizing their business process to meet their specific market needs.

Optimizes the Insurance Sales Cycle

Insurance agents and brokers have enough to handle without having to worry about an inefficient sales cycle. The agency of the future helps them stay organized by enabling access to all of the data and documentation they need from their mobile devices, including policyholder information and sales collateral, for mobile productivity and in person selling.

The agency of the future also provides sales managers with advanced management insights, so that they can streamline lead and prospect management for their teams and segment by agents or brokers, territories, and product line. Finally, the agency of the future leverages automation to take the grunt work out of insurance sales, so agents and brokers can focus on what they do best: providing customers with an exceptional experience.

Delivers Best-in-Class Customer Service

Although insurance carriers underwrite policies, oftentimes agents or brokers are policyholders’ primary point of contact, making them the face of the company. As such, agents and brokers play an important role in customer service, answering policy questions, providing claims support, processing changes and renewals, and so on.

The agency of the future makes it easy to provide high-quality, personalized service and support by giving agents and brokers a 360-degree view of each policyholder using customer relationship management (CRM) technology. In fact, according to Capgemini’s 2021 World Insurance Report, 56% of agents and brokers who use digital CRM tools with a 360-degree view of customers find it effective in providing a superior customer experience.

Ensures Brand & Data Consistency…

With each merger and acquisition comes the consolidation of countless different tools, systems, divisions, people, and processes — which can easily lead to internal discrepancies and an inconsistent brand experience.

Additionally, the acquisition of data assets is a cornerstone of any merger, though often without the underlying infrastructure to take advantage of all insights the new data can provide. The agency of the future utilizes a mature, highly scalable system capable of ingesting new data and generating insights from mergers or acquisitions that enforce its brand.

…While Supporting Personalization

Although consistency is key, it’s vital that the local office and individual agent or broker have the ability to tailor their offerings based on the unique needs of their customers. These needs can vary based on a wide variety of factors, including region, demographic, environmental climate, and more. For example, a homeowners policy for a customer in California would likely need to cover damage from wildfires, whereas a homeowners policy for a customer in Louisiana would need to cover flood damage.

Therefore, the agency of the future uses a system that has the ability to deliver a consistent brand experience while maintaining the flexibility to meet the localized needs of agents and brokers in different areas and lines of business.

Offers a Seamless Omnichannel Experience

The modern insurance customer experience spans multiple channels, both online and in person. According to data from the World Insurance Report, agents and brokers remain the most popular option for researching and purchasing policies across both personal and commercial lines; however, digital channels such as smartphones, chat, and email come in at a close second.

The agency of the future is primed to offer a seamless omnichannel experience, including self-service options, enabling existing and prospective customers alike to purchase policies, seek support, file claims, monitor open claims, and more across multiple channels without any interruption in service.

Leverages the Latest Technology

The agency/brokerage of the future has its finger on the pulse of innovation and takes advantage of the latest tools and technology, including artificial intelligence, machine learning, and predictive analytics. It uses advanced analytics to generate data-driven insights that inform sales strategies, such as which products are most popular by division and region; provides agents and brokers with multiple self-service options, including virtual agents, to easily look up policy information; supports mobility so agents and brokers can manage sales onsite or from their local office; and more.

Dynamically Adapts to Changes in the Market

Thanks to predictive analytics, the agency of the future can anticipate and plan for disruption, forecast industry trends, quickly develop new product lines, and proactively identify revenue-generating opportunities, all of which enable it to maintain market share and enhance its competitive standing.

Looking to the Future: Industry Predictions

We’ve spoken at length about the agency of the future — but what does the actual future of the insurance industry look like? Here are some leading predictions:

- Insurers will prioritize value-added services over products. The insurance industry is, by its very nature, reactive. However, insurance companies are fast learning that this approach is no longer sufficient to meet the demands of the modern customer, who expects a high level of personalization and looks to their insurer for security.

According to Forrester, this emerging dynamic will prompt insurers to bake value-added services into their underwritten coverage — services such as interactive risk reduction tools, educational content, personalized advice based on customer behavior, custom-configured product bundles, and more.

- Insurance will become “Digi-intermediated.” Coined by CapGemini, the term “Digi-intermediation” refers to “a seamless environment where human channels are digitally empowered and sophisticated on-demand digital features humanize virtual channels.”

More than just a new buzzword, Digi-intermediation imagines an insurance industry in which:- Agents and brokers are equipped with the tools they need to seamlessly switch between physical and digital engagement models — tools such as video conferencing software, agent portals, and feedback management solutions — and engage with policyholders on a more consistent basis.

- Insurers expand their partner ecosystems to include companies in complementary industries, such as financial services, healthcare, retail, hospitality, and more. These partnerships will enable insurers to embed their products into partner offerings, thereby extending their reach and creating symbiotic relationships.

- Insurers embrace an “open insurer” mindset, moving away from product-centric distribution and messaging and instead working collaboratively with external partners to offer services that meet policyholders’ unique needs, such as usage-based policies and on-demand insurance.

- Connected insurance will find its footing. Once perceived as pure hype, connected insurance — that is, use of artificial intelligence (AI), the internet of things (IoT), telematics, and other advanced technologies to create tightly connected digital ecosystems — will soon become standard practice as insurers continue to evolve to meet the needs of a digitized world.

To better understand the nature of connect insurance, a brief example: In exchange for an incentive — say, a lower premium — an auto insurance customer agrees to install an IoT-connected telematics monitor in their vehicle. This enables the insurer to monitor the customer’s driving in real time and apply advanced analytics to that data in order to develop a highly accurate risk profile. The insurer can then develop a custom-configured policy for the customer based on their determined risk level.

And this is just a basic example of connected insurance capabilities; all told, combining hyper-automation and low-code development with AI and other related technologies, insurers will be able to design more cohesive customer experiences and adapt to changes within the industry at speed.

- Insurers will build new business models and tap into new revenue streams. We expect to see insurers build new business models capable of supporting changing customer expectations and capitalizing on emerging industry trends, all in the interest of competing with digital players and capturing new market share while still protecting core business.

Forrester predicts that this will result in “vertically integrated insurance companies [dissolving] into looser federations of specialist business units that will focus on different core competencies in the insurance value chain.”

These specialties will likely consist of:

- Insurance marketplaces, will provide a “mechanism for insurers to unlock existing liabilities held on their balance sheets and [enable] institutional investors to diversify their portfolios.”

- Policy manufacturers, will build dynamic, customized policies and policy bundles based on customer needs and wants, with the flexibility to adapt to changes in the marketplace.

- Insurance distributors, will tailor coverage according to customer needs, offer value-added services and other add-ons, and utilize on-demand and direct-to-consumer distribution models.

- Customer service orchestrators, will leverage their ecosystem management competencies to design and deliver seamless, cross-channel customer journeys.

- IoT device integrators and data aggregators, will capitalize on data opportunities and advanced technology to optimize pricing and underwriting and deliver personalized customer experiences

- Insurance-as-a-Service providers, which will provide turnkey digital capabilities to other companies so that they can launch white-labeled insurance offerings.

Start Your Evolution with Hitachi Solutions

In order to prepare for the future of the insurance industry, it’s imperative that you start with a solid IT infrastructure.

Microsoft Dynamics 365 is a mature, end-to-end platform designed to help agencies and brokerages out-innovate the competition using intelligent insurance solutions powered by cutting edge technology. Designed with the realities of the modern insurance industry in mind, Dynamics 365 enables agencies and brokerages to create templatized systems, processes, and records that ensure consistent company branding, while still providing local field offices, agents, and brokers the flexibility to customize offerings to their customer base.

Dynamics 365, with its inherent AI and machine learning capabilities, leverages the full power of the Azure cloud to provide highly scalable storage that can easily accommodate your agency or brokerage’s changing storage needs, no matter how many mergers and acquisitions you undergo. But Dynamics 365 doesn’t just ingest data — by applying advanced analytics, it enables you to generate granular insights and create data visualizations that empower you to optimize your quoting process, take advantage of the latest industry trends, uncover hidden efficiencies, and seize new market opportunities.

The future is now — contact Hitachi Solutions today to get started.